Premium Report

The Pro Trader’s Almanac Trade: Your Chance to Clock Monster 24-Hour WINS Every Day!

Bryan Bottarelli, Head Trade TacticianThe market can be unpredictable – even at the best of times.

For the investor looking for reliable profits, it may seem like there isn’t anything to do but grin and bear the unpredictability.

Fortunately, there are predictable profits to be made in any market through overnight trades using my Pro Trader’s Almanac – the single best way to turn earnings releases into monster paydays.

This POWERFUL strategy uses precise methodology… You’re trading NOT a stock’s direction but rather its movement.

You see, the U.S. Securities and Exchange Commission (SEC) requires every publicly traded company to publish quarterly reports of its financial results.

So on any given day, there could be hundreds of companies publishing their earnings.

Now, regardless of whether these results are good or bad, we can WIN EITHER WAY!

The earnings announcements can cause big moves in the share prices of the companies that published them.

And I’ve developed a three-part evaluation criteria to pinpoint ONLY the stocks poised to make the biggest moves. Once I have the small group of companies that are ripe for a Pro Trader’s Almanac trade… I write up the exact trade and share it with our trading research community.

Let me break down the metrics and show you how we will take big profits fast!

Spare a Thought for Poor Richard

Back in the colonial era, Poor Richard’s Almanack, written and published by Benjamin Franklin, was indispensable for early American farmers.

It featured weather predictions that were pretty accurate for the time, astronomical information, household advice, and even some wordplay and phrases from Franklin himself.

Consider this report and our calendar your own Almanac for racking up monster wins on a daily basis. Just like how Poor Richard’s Almanack helped farmers make the most of their land and planting seasons, this report will help you make the most of your money. Here’s how…

The first criterion for Pro Trader’s Almanac trades is to play earnings announcements…

In the Securities Exchange Act of 1934, the federal government instituted the requirement for quarterly and annual reports in the name of fairness and transparency as well as to prevent insider trading. It makes sense that shareholders in a company have a right to know how the company is doing in detail.

Almost every trader knows that big moves in a stock can happen right after an earnings announcement.

But most people think earnings announcements happen only four times a year, in January, April, July and October.

However, that’s just when the media focuses on the most popular companies.

And that hands us one incredible profit opportunity after another… day in and day out.

For example, take a look at the first couple of weeks in May 2024, a month that falls outside of what most people think of as “earnings season.”

On May 6, 295 companies are scheduled to announce earnings. There are 425 companies scheduled for May 7 announcements. And May 9 has 405 companies to choose from.

There are earnings announcements scheduled every day the market is open in May, some of them even over the weekend. These dates are set in stone, so we know when they’re coming and who the candidates are thanks to the SEC’s online calendar.

And we are zeroing in on dozens of opportunities to come this year. They’re all laid out in a publicly available format online that you can access for free. Yahoo Finance has one of our preferred ones, which you can see here. But for now, let’s get back to what makes these Almanac trades so powerful…

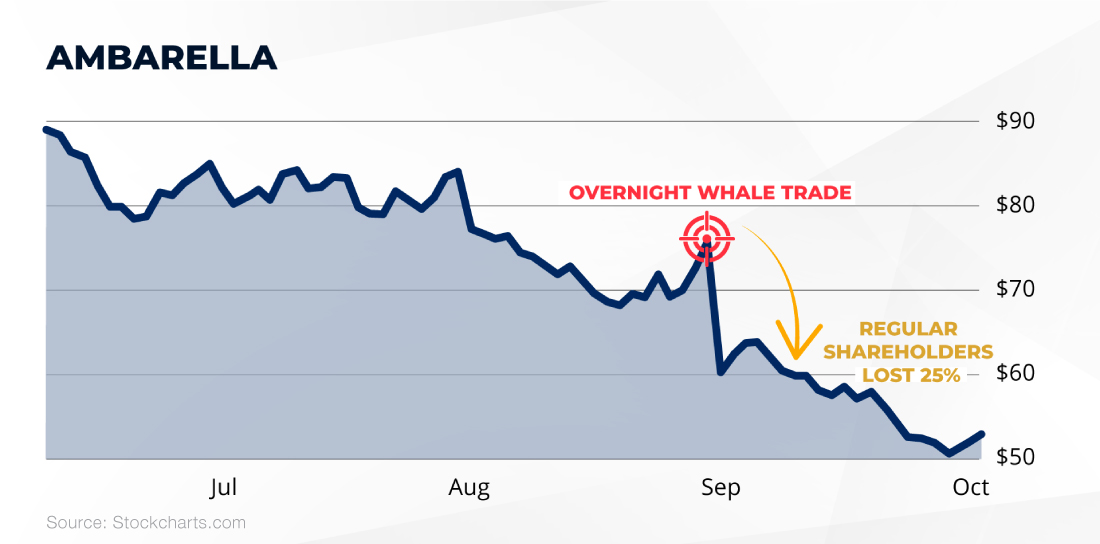

Ambarella is a prime example of a Pro Trader’s Almanac trade – the company had all three criteria we pinpoint.

So I recommended a special trade on it in The War Room during the trading session before the company announced earnings. The biggest moves always happen on earnings day, so we wanted to place our Overnight Trade… logically… the night before.

Within 24 hours, the stock had dropped by 25%.

And we saw one huge 24-hour gain of 124%!

Remember, with this special trade, it doesn’t matter whether the stock goes up or down.

It gives us the chance to win either way, not just on the downside.

So now that we know the event we’re trading on, we need to know what to look for in the individual companies we’ll be trading…

The Greatest Showman

The second criterion is also one you may be familiar with.

I named it after one of the most flamboyant traders in recent history… His name was Joe Granville.

So I call this the “Granville” effect.

Now, Joe was quite a character… and a known showman.

He was a financial newsletter editor in the 1970s, ’80s and ’90s. And he became a legend in part because of his crazy antics.

For example, he was carried into one conference in Atlantic City in a coffin, and he “resurrected” himself in front of the crowd with a martini in hand. At another conference in Tucson, he made his entrance by walking on water across a pool, telling the crowd, “Now you know!”

He was a character… But Granville was also a well-known market forecaster, and one best known for the market indicator he invented.

It was based on the principle that greater volume means greater conviction – volume being the number of shares of a stock being bought or sold at a given time.

It’s a no-brainer when you think about it. After all, 10 million shares traded is obviously more significant than 1 million.

Now, we’ll be using volume a little differently than Granville did, but the principle is the same. A large surge in volume can signal that a large move in a stock could be about to happen…

Now, again, the common theme here is that we use a type of trade that makes money whether the stock moves up or down.

It simply doesn’t matter whether shares soar or tank…

So we don’t care if the volume surge is from buyers buying or sellers selling. As long as we get a significant move in either direction… we’re golden.

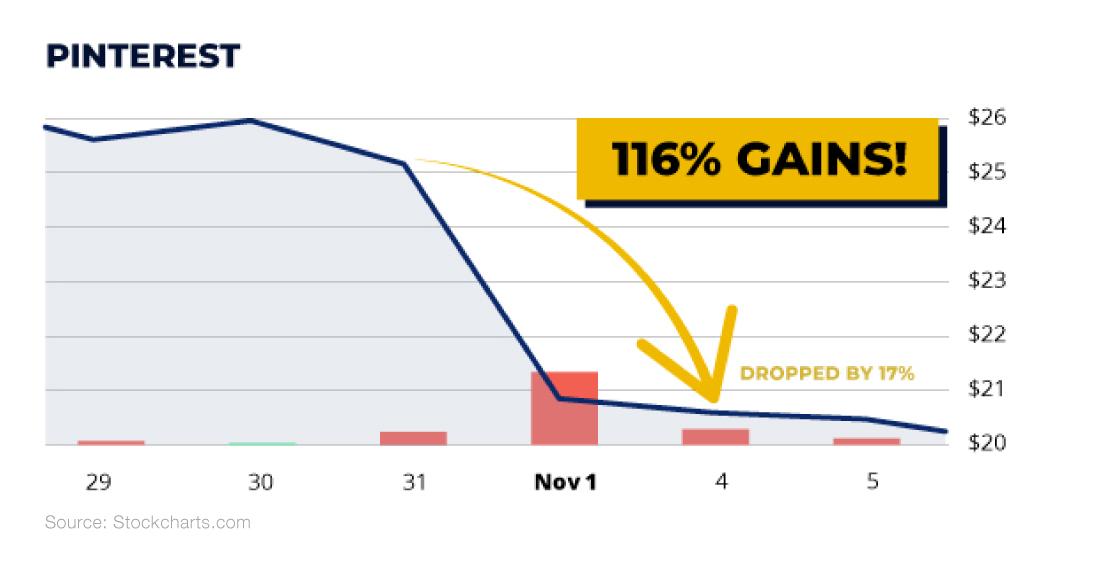

Look at Pinterest…

It was scheduled to announce earnings after hours on October 31. Right before that, its trading volume spiked over the previous day by 241%. That told us the smart money was either pouring into OR out of the stock.

We didn’t care which direction as long as it would be a big move either way.

In this case, I recommended placing our trade right as volume was spiking.

Sure enough, shares of Pinterest dropped by 17%…

Which is exactly what we wanted to see, so I recommended the play to The War Room. Anyone who followed my recommendation saw a 116% gain in one day.

So we’re looking for a spike in volume – one that’s double the volume of the previous day – in the session right before an earnings announcement. And volume tends to shoot up most in the final hour of trading, between 3 p.m. and 4 p.m. ET, so that’s the window we will be focusing on.

But how do we identify which stocks are building momentum for the big swing we’re looking for? Well, that’s a job for the third criterion we use, our targeting mechanism…

Taking Aim

Weirdly enough, our targeting mechanism was first developed by the U.S. Navy to track submarines during World War II. And later it was used to design missile tracking systems to intercept extremely high-speed objects, like satellites in orbit.

We’re talking about an exercise in precision here… Because at an altitude of 124 miles above Earth, to achieve an orbit… satellites have to travel at 17,000 miles per hour.

So shooting one down is like hitting a bullet with another bullet. Obviously, precision-guided missile systems need to be pinpoint accurate. The problem is that outside forces like wind or air density can push the rocket off target.

At those speeds… millimeters can turn into miles in the blink of an eye.

And of course, when you’re trying to hit an object traveling at supersonic speeds, the missile needs to continually adjust its trajectory. So the military needs a way to constantly steer its rockets back on target.

This is called “proportional control.” And figuring it out was left up to a rocket scientist named Pete Haurlan who worked for the Jet Propulsion Lab at Caltech in the 1960s.

Today, precision-guided missiles are reported to be deadly accurate, landing within 10 feet of any target.

So Haurlan’s work paid off. But here’s the twist!

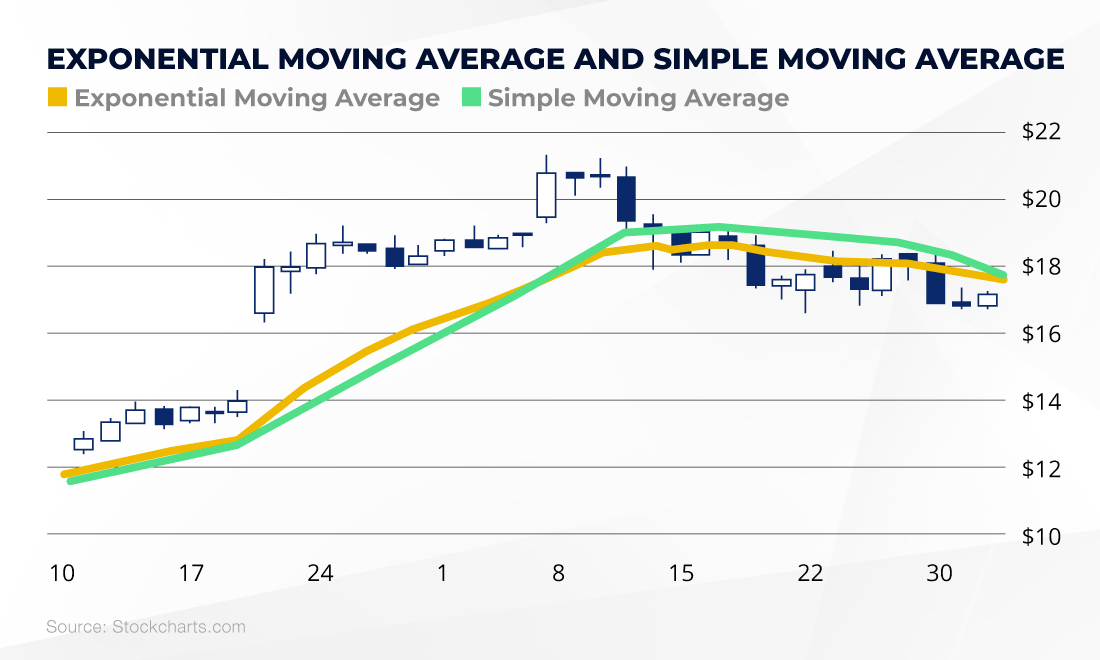

As luck would have it… Haurlan was also interested in stocks. After hours at JPL, he would use the same system to track share prices. And that’s how we got the nine-day exponential moving average (EMA) we use in our profit calendar.

It’s not one that many investors have heard of, but when the price of a stock lines up with it, along with a big jump in volume right before an earnings announcement, it’s a precise indicator that a big move in the stock is likely imminent.

Moving averages filter out the background noise of the market using an average of prices over a specific time frame to show you which direction a stock is moving. EMAs place more weight on more recent prices than older ones.

And our moving average takes into account the nine trading sessions preceding the earnings release. When the share price hits the nine-day EMA line and there’s a big spike in volume, that’s our signal. Because what happens next can be very powerful.

You see, when the price and the moving average intersect, it tells me that the bulls (people buying the stock and trying to drive it up) and the bears (people selling the stock and trying to drive it down) are in a deadlock.

The tug-of-war is in a dead heat, and neither side is able to make the share price move. The number of buyers and the number of sellers are roughly even, and the stock is primed for a big move the second one side wins out.

The direction of the share price is uncertain, and that uncertainty can be good for traders. And the earnings release is what’s likely to tip the scales in favor of either the bulls or the bears.

What we’re looking for is a massive spike in volume, ideally of 100% or more over the previous day, on the day before the earnings release comes out. That’s a signal that one side is about to positively clobber the other…

But it doesn’t matter to us which side wins the tug-of-war. So how are we actually going to make this trade in such a way that we profit no matter what?

The answer is a play called a strangle.

Stranglehold…

So we have a spike in volume the day before the earnings release is due to come out intersecting with a nine-day moving average on a stock. How do we know what the results will be, and how do we win either way?

The short answer is that we won’t know what the earnings report will say until it’s out. We can guess, but we don’t want to trade on a guess. That’s no better than gambling. So instead we’ll trade on what we know…

Controlling for everything else, we know that if a stock meets the three criteria I’ve already discussed in this report, it’s likely to have a big move up or down when its earnings report comes out. To capitalize on that, we will be making an earnings strangle play.

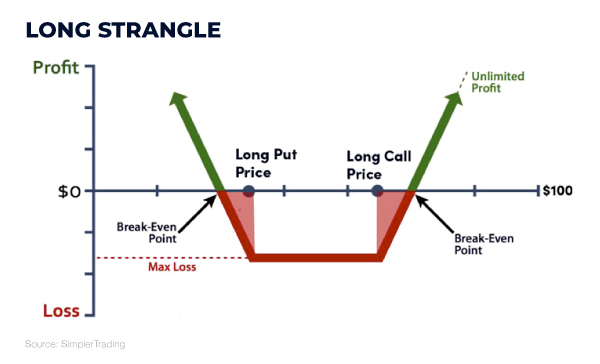

In simple terms, you set up a strangle by simultaneously buying an out-of-the-money call option and an out-of-the-money put option with the same expiration date on the same stock.

This establishes a position that theoretically has unlimited profit potential on the upside and limits any downside losses to a predetermined amount – the amount you spent on the options.

Set it up correctly, and you’ll have a balanced position of calls and puts on the same underlying asset on the same expiration date, but with different strike prices. Getting positioned on both sides of a trade like this forms a strangle.

The goal is to profit from a big reaction to a company’s earnings in either direction, up or down. When executed correctly, you’ll profit from a sizable reaction without even knowing the direction.

Here’s how that looks in practice…

Let’s say that Company X is trading at $522 a share and is scheduled to report earnings on March 6. You want to take advantage of a strangle…

Which you could establish on March 5 by buying the following zero-day options…

You buy Company X’s $523 calls that expire on March 6. You also buy the company’s $521 puts that expire on March 6. Those prices are just above and below the share price at the time you set up the strangle…

Let’s say the call costs you $1.69 per share, or $169 for the whole contract, and the put runs you $0.74, or $74 for the whole contract, so your total cost to set up the strangle is $2.43 per share, or $243.

Now, you don’t know whether the report will be good or bad news for Company X, but if the stock makes a big move, the direction won’t matter. This play will still turn a profit.

So say Company X’s earnings are rather positive, revenue and income are up, debt is down, all is good. And as a result, the company jumps from $522 to $532.44, which is a 2% gain (and a large move for a stock this expensive, but it will serve to illustrate how even a relatively small percentage increase can create massive profits on a strangle). Because of this, your calls are now worth $944 while your puts expire worthless.

Take your $944 gain from selling the call option (there’s no gain on your puts as they are now worthless) and subtract your entry cost on the strangle ($243), and you have a total gain of $701 on the trade. That works out to a 288% gain overnight!

($944 – $243) / $243 = 288.48%!

In this scenario, your options transformed a 2% gain in share price into a 288% gain.

That’s because the substantial gain from the calls far outweighed the complete loss from the puts. You took home a triple-digit winner on the earnings move without even knowing whether it would move the stock up or down.

In sum, executing the strangle has the following distinct advantages.

The move: Reactions to government reports are often responsible for the largest single-day moves an index will make. And that’s precisely when you want to be involved because that’s when the money is made.

The timing: You know the exact timing of every trade you’re going to make. That’s because every earnings announcement is scheduled well in advance by the SEC. This allows you to plan your entry and exit orders accordingly. There’s zero guesswork when you have zero directional risk.

When companies release earnings, most traders swing for the fences and speculate on only one direction, up or down.

Sometimes they win, and other times they lose. But it’s always a coin flip. Over time, they’re unlikely to come out significantly ahead.

But with strangles, you remove that guesswork. When you play both directions together, all you care about is whether the stock moves 5% or more on earnings day.

When done correctly, as long as the stock moves up or down that much, you’ll win. In the process, your odds of success will increase significantly. Even factor in some earnings clunkers, and the odds of 100%, 200% or even 450% returns remain in your favor.

Win Both Ways… in Any Kind of Market

With the profit calendar, we can take home wins daily on earnings reports no matter which way they cause the stock to move.

And thanks to the SEC and earnings releases coming out all the time, it’s as close to a sure thing as you can find in any market, especially in a market as volatile as the post-COVID one we’ve had for the past few years.

This guide and the strangle plays we’ll be using to profit from earnings releases are excellent tools to have in your back pocket as we move forward into whatever the market has in store for us in 2024.

It represents the single greatest trading advantage in the stock market, and now that you have the strategy spelled out in this guide and understand the earnings calendar, you’ll be ready to trade target stocks on the specific dates they’re most likely to generate profits.

But here’s the best part… I’ll do all the heavy lifting for you! That’s right. I will be tracking the overnight trades every day the markets are open.

If any stock about to announce earnings meets my criteria, I will issue a new trade right inside The War Room – always in real time.

The trade will also get delivered to you via email, so you can see my exact instructions on the go.

You can, of course, go out and look at the hundreds of upcoming earnings announcements yourself. As you saw in the calendar example above, hundreds of companies could be announcing earnings on any given day. But rest assured… I will be doing the hunting for you every day the markets are open. So there’s no need for you to track all the setups and potential trades on your own – or at all. I’ve got your back there.

To get started, just log in to The War Room here. Our very next overnight trade could be today… and tomorrow morning could be “Time to ring the register!” for double- or triple-digit gains.