Premium Report

The 10X Profit System

Guaranteed Profits When the Market Drops

Bryan Bottarelli, Head Trade TacticianThe media wants you to believe there’s nothing you can do to protect your money when the markets tank…

But that is absolute bunk. It’s a flat-out lie… And you’re not even allowed to ask if you should do something to protect your money. You’ll always get the same advice: buy and hold. When the market dips, buy the dip.

That’s because the media, the banks, financial advisors and Wall Street brokers all have one goal: get as much money from you as possible to fund their casinos so they can enjoy their lavish lifestyles.

Their biggest fear is losing business. It’s that simple. The less money you put in the “diversified” portfolio they recommend, the less commission they make.

Sure, buy-and-hold works…

If you’re Warren Buffett and have enough money to eat the losses in bad years or if you’re right at the start of a bull market and every stock is on the rise.

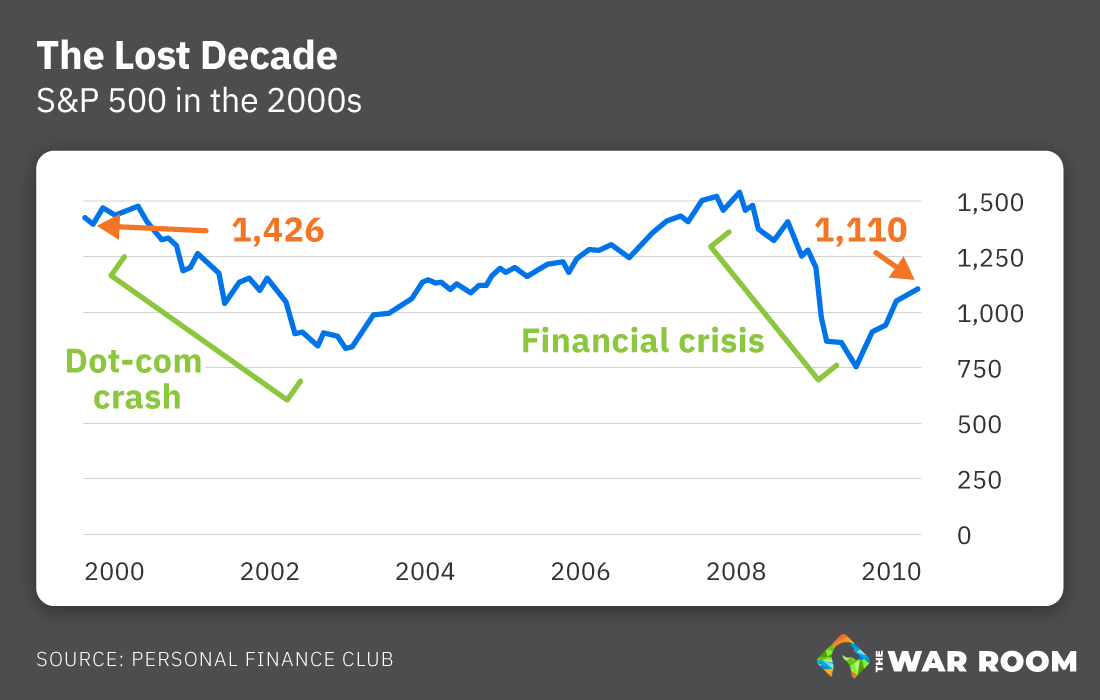

And sure, the market may always come back. But that idea doesn’t provide much comfort to someone who was only a year away from retirement when the market tanked and is now staring down the barrel of commuting to work every morning well into their 70s.

It happened during the “lost decade” of the 2000s, it happened in the ’70s and ’80s, and it can happen now… I’d wager that it is happening now.

But losing money in the market is “normal” only if you agree to it. However, you don’t have to agree to it anymore.

And it’s all thanks to one special asset specifically designed to rise as the market falls…

I’m talking about inverse exchange-traded funds (ETFs). And they’re the secret to booking 2X, 5X and even 10X gains, all while the market is crashing and burning.

The Best Kept Secret on Wall Street

You’re likely familiar with ETFs. They’re essentially baskets of stocks designed to follow broader trends in indexes, industries or sectors.

For example, an S&P 500 ETF owns shares in all 500 stocks on that index. It acts as a much cheaper way to own shares in that index.

ETFs are great if you have limited funds but still want broad exposure to the markets that you’d otherwise need to be a millionaire to get.

However, most ETFs follow the same direction their underlying index or industry moves in. If the S&P 500 goes up, the ETFs tracking it will go up. If it goes down, the ETFs will in turn go down.

But there are several ETFs that do the exact opposite. They’re called inverse ETFs, and they’re meant to move in the opposite direction of their underlying stocks. So an inverse ETF on the S&P 500 would go up when that index goes down.

Unlike normal ETFs, though, inverse ETFs are not buy-and-hold investments. They use a combination of puts, shorted shares and other tricks that make them useful as short-term plays.

Using one is like shorting shares without the associated risks. See, when you short a stock, you borrow shares that you don’t own and sell them immediately, anticipating a dramatic drop in share price. Then, you buy them back at a lower price, return the shares and pocket the difference.

It sounds simple in theory, but in practice, it’s more like a game of Russian roulette. If it works out, your gain potential is still limited. The shares can drop to $0 at minimum.

But if those shares increase in value, you still need to return them to whomever you borrowed them from. So your losses could theoretically be infinite, as there technically is no upper limit on how high a stock can go.

An inverse ETF has the same short-term gain potential as shorting shares with significantly less risk. It has “limited risk” – aka the amount you invest – instead of unlimited risk. If your inverse ETF play goes against you, you just ditch the shares you bought in that ETF. You don’t assume any of the risk that comes with shorting shares – the company running the ETF does that.

But the profit potential of inverse ETFs doesn’t end there.

Some ETFs, both regular and inverse, are leveraged. This means they magnify the movements of the stocks they track. For example, a 2X leveraged ETF on the S&P 500 would double whatever moves the S&P made. If the S&P went up 5%, the ETF would go up 10%… Same story on the downside.

That means leveraged ETFs are already set up to deliver 2X gains on the market. From there, it’s easy to see how 5X and 10X gains are not difficult to achieve using them.

And here’s where inverse ETFs get wild. Say we’re using a 3X leveraged inverse ETF on the S&P 500. If the S&P dropped 10%, our ETF would go up 30%. So when the market loses, you can win and win big with inverse ETFs.

You DO NOT have to lose money when the markets go down.

Not anymore.

And the three inverse ETFs that I trade in The War Room are frequently your keys to big gains when the market crashes and burns.

The Three Stooges

There are nearly 3,000 ETFs on the market, but we’re going to be using only three of them to capitalize on downward swings in the market.

These ETFs are the ProShares UltraShort Dow30 (NYSE: DXD), which is pegged to the Dow Jones Industrial Average, or Dow 30… the ProShares UltraShort QQQ (NYSE: QID), which tracks the Nasdaq index… and the ProShares UltraShort S&P500 (NYSE: SDS), which is paired with the S&P 500.

And I’m going to give you a brief introduction to all three so that you know what I’m recommending when I tell you to play these. But before I do that, I need to explain something very important.

Many other ETFs are buy-and-hold assets – you buy them with the intention of hanging on to them for weeks, months or even years. These inverse ETFs are not that. These assets reset at the end of every trading day. You’re meant to hang on to them for only a few trading days or weeks, at the very most.

With that in mind, we will be entering and exiting each of these plays within a very short-term trading window.

Now, without further ado, let’s talk some inverse ETFs…

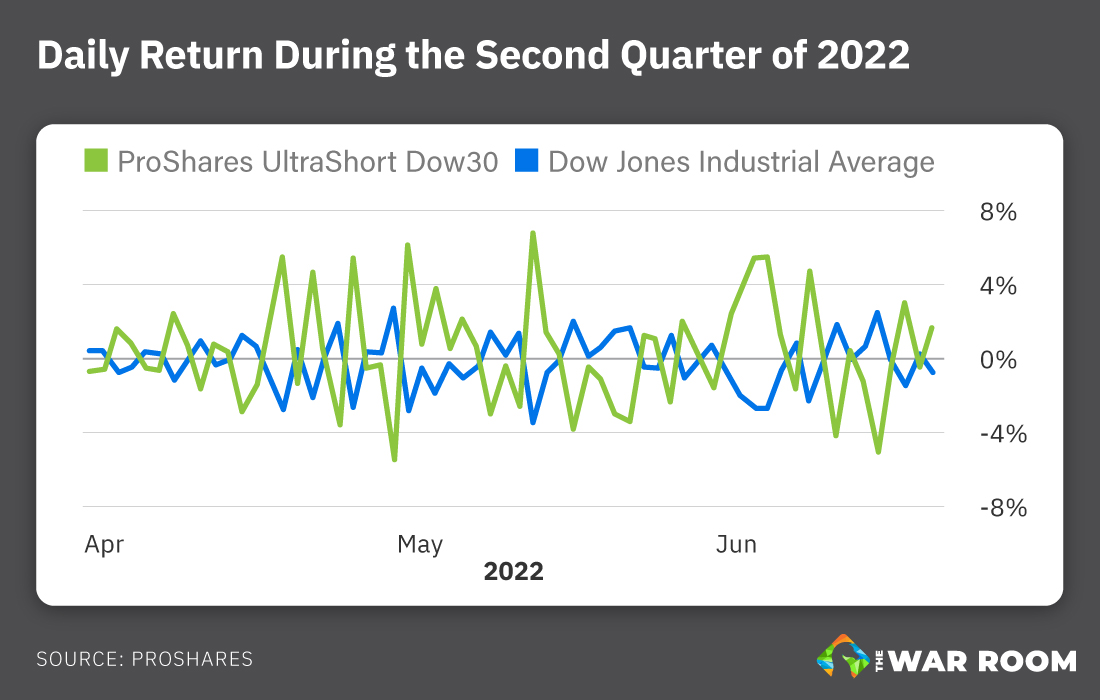

Let’s start with the ProShares UltraShort Dow30 ETF. As I mentioned before, this ETF is pegged to the Dow, and it’s designed to move 2X in the opposite direction of the Dow. If that index dips, this ETF will move double that in the opposite direction.

If the Dow drops 4% in one day, this ETF is meant to rise by 8%. Just take a look at this chart to see what I mean. Each time the Dow rises or falls, this ETF moves in the opposite direction times 2.

This ETF gives you exposure to all 30 companies on the Dow, and in a year like this one, with volatile bearish movements marketwide, it’s a fantastic play. Since the start of 2022, this ETF has had a nearly 30% return. Mind you, this is not a buy-and-hold asset – to get returns like that, you must trade it actively when the Dow dips.

It’s the same story with the other two ETFs in this report…

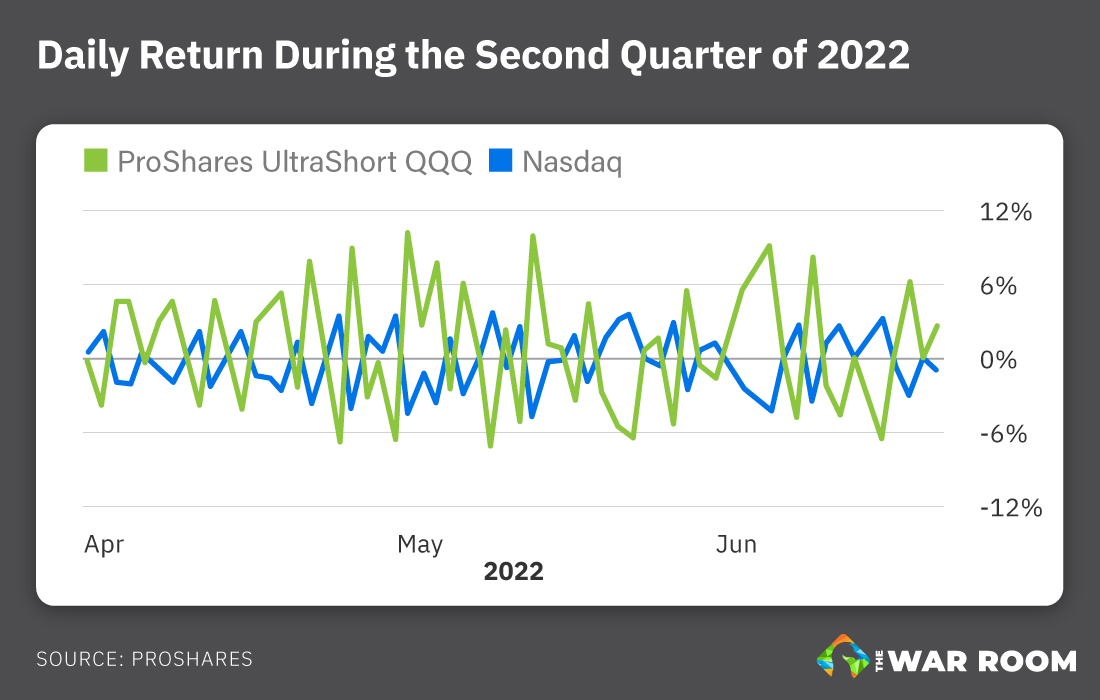

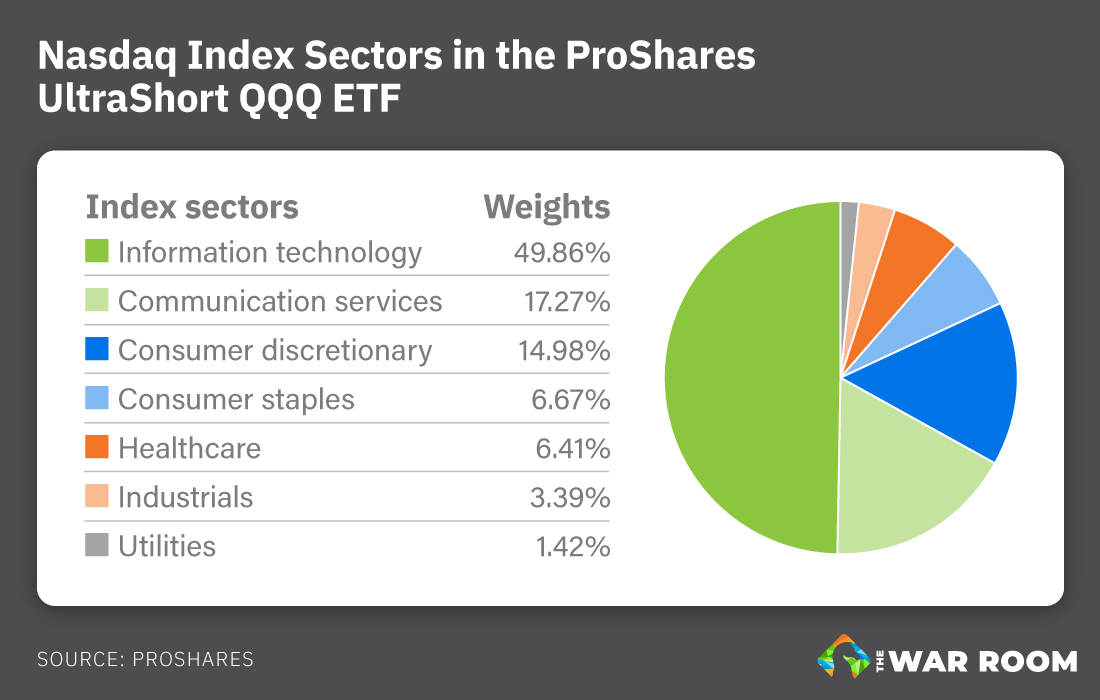

The ProShares UltraShort QQQ ETF works the same exact way as the ProShares UltraShort Dow30 ETF does, but it’s pegged to the Nasdaq. It’s also a 2X leveraged inverse ETF. So for every point the Nasdaq drops, this ETF will increase by two points… and vice versa. If the Nasdaq climbs, this ETF will drop 2X whatever the Nasdaq is up by…

Since the start of 2022, the ProShares UltraShort QQQ ETF has returned nearly 70%. Tech stocks have been having a rough go of it in 2022, and the Nasdaq has a lot of tech stocks on it. Nearly half of the stocks this ETF holds are in the information technology industry.

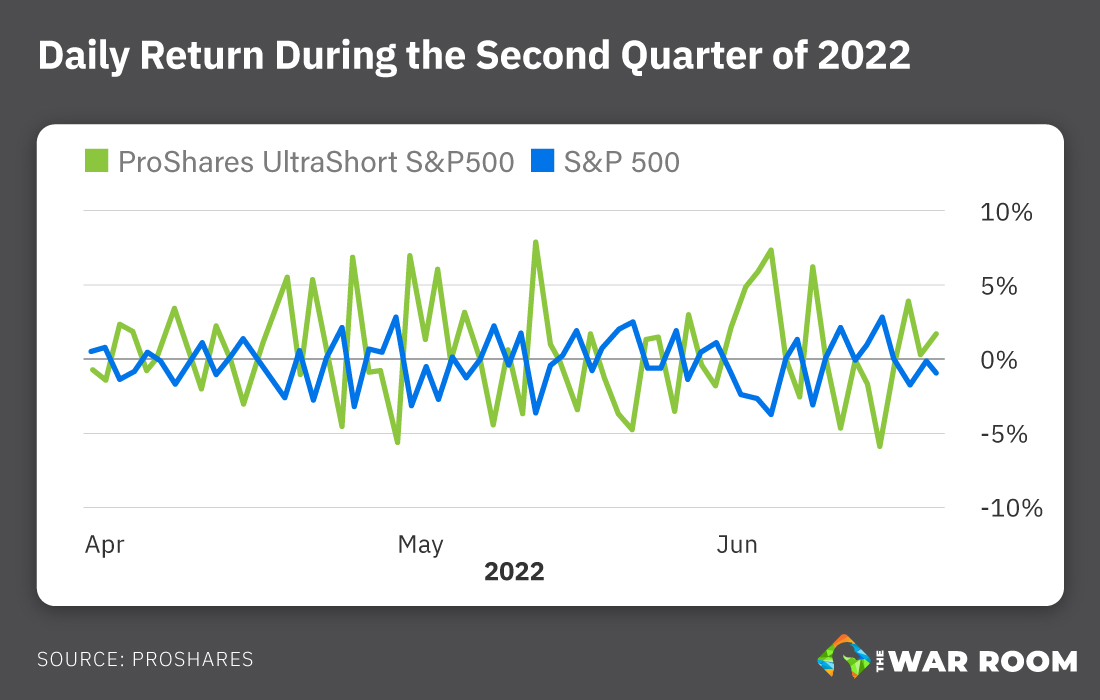

And that brings me to my final inverse ETF, the ProShares UltraShort S&P500. Like the other two ETFs, it’s a 2X leveraged inverse ETF designed to profit from a market decline and hedge your portfolio against an expected market drop.

It works the exact same way as the other two do, but it’s pegged to the S&P 500, the most diversified of the three major indexes and arguably the most accurate bellwether for the market overall, as it’s composed of the 500 largest companies listed on American exchanges.

And like the other two, this is a 2X leveraged inverse ETF. If the S&P 500 drops 5% in a single day, this ETF is meant to rise by 10%… and vice versa.

Now, you can further leverage these ETFs through call options, and that’s how you can turn these 2X leveraged ETFs into some 10X super-leveraged options plays. That is exactly what we do in The War Room. Let’s get into those details…

Using the 10X Profit System on Leveraged ETFs

As I showed you above, a 2X leveraged inverse ETF can increase 10% if the markets drop 5%. The same goes for smaller moves. A 1% drop on the Dow can hand you a 2% gain on the ProShares UltraShort Dow30 ETF.

If you want to boost your returns and 10X the moves of these inverse ETFs, you can do so with a simple call options strategy – as we do in The War Room.

Here’s an example of a trade we did on the ProShares UltraShort Dow30 ETF…

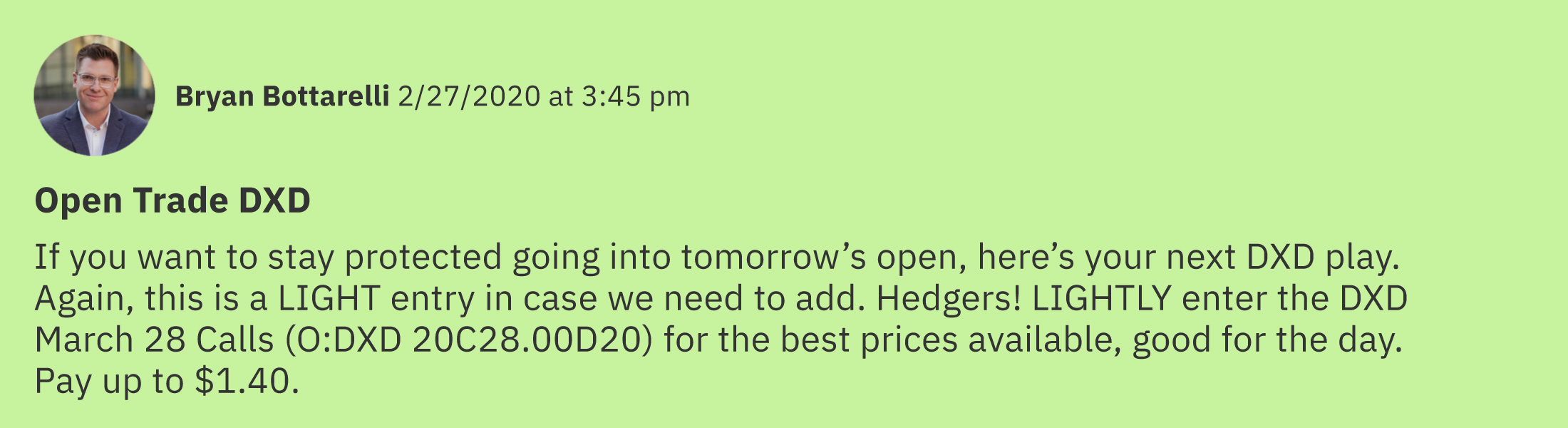

In The War Room on February 27, 2020, I recommended buying the March 20 $28 calls for $1.40 or less as a hedge against a potential market downturn.

Now, if you’ll remember, the COVID-19 pandemic was just getting started back in February 2020. At the time, the CDC was hemming and hawing over whether or not to declare the rapidly spreading disease a pandemic…

But in The War Room, we saw the writing on the wall. The pandemic was right on the horizon, and so was the market crash in March 2020 that I’m sure you remember. The Dow’s 3,000-point loss on March 16, 2020, was the largest single-day drop in U.S. stock market history, after all…

That catastrophe was still a couple of weeks out, but needless to say, the market was volatile in February 2020 and was prone to making big swings – so hedges became very good ideas. Nobody knew exactly what the market was going to do, and that’s exactly why I recommended the ETF.

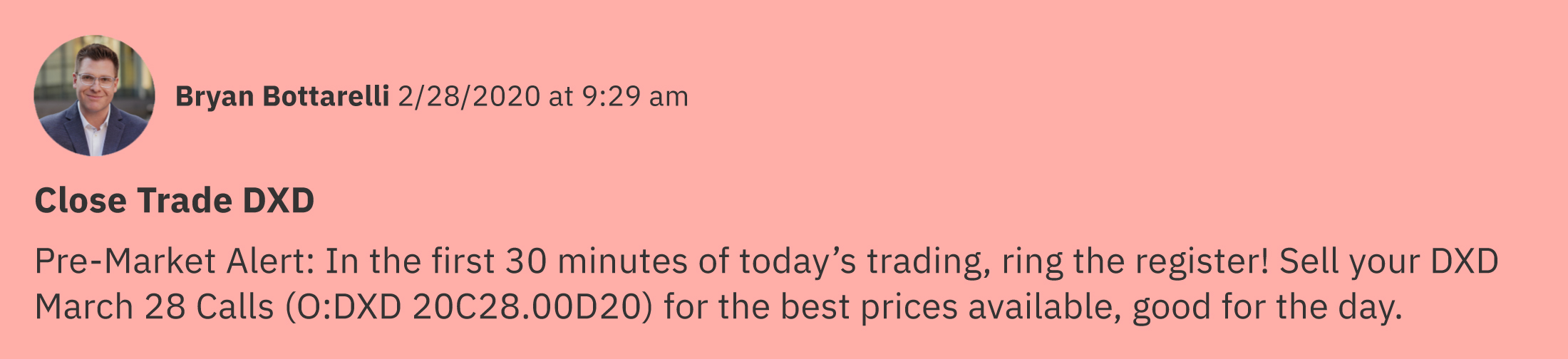

When we exited the play the next day, that same ETF had gone up 7.75%, a big move for such a short period of time. But because we placed a call trade, our options magnified that move even further…

We entered the trade at $140 per option, and we sold for $267 per option, a 90% overnight gain…

The market dropped, but we made nearly 10X on our investment. Some War Room members did 10X their investments, and some racked up even larger gains.

Both ETFs and options are fantastic tools in the hands of skilled investors. Individually, they can allow us to profit whether the market goes up or down. But when you combine the two, you can compound the leverage you have on the market.

It’s like the Greek mathematician Archimedes once said: “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.”

Well, inverse ETFs and options together will put a really big lever in your hands. And you’ll be able to move the market in your favor, upward or downward…

No matter what the media tells you, you don’t need to accept losing money when the market dips ever again.

Instead, you can turn it to your advantage and use Wall Street’s tricks to bring profits to Main Street.

So to summarize…

- Do use inverse ETFs when you anticipate the market dropping.

- Do not hold inverse ETFs long term.

- Do use inverse ETFs as short-term plays to capitalize on market drops.

- Do use inverse ETFs as ways to play the market’s downsides without the risks of short selling.

- Do not think you have to lose money just because Wall Street thinks you should.

Now that you’re part of The War Room, you can start trading these inverse ETFs to make money when the market goes down. Never accept the lie that a bear market means you’ll have to eat losses.

We hope you’re excited, because this could change the way you approach your investing and trading forever.

Welcome to The War Room! We’re glad that you’ve decided to join our elite community of traders!