Premium Report

Karim’s Winning Trading Techniques: A War Room Breakdown

Karim Rahemtulla, Head Fundamental TacticianOur tacticians deploy a wide range of trading strategies to win every day in the markets.

In this report, we’ll break down Head Fundamental Tactician Karim Rahemtulla’s most frequently used strategies in The War Room. We pulled together all the live “training content” he provided in the Members Chat over time that really resonated with members.

So let’s get started by discussing one of his favorite strategies used to generate income. Take it away, Karim…

Ryan Fitzwater, Associate Publisher

Monument Traders Alliance

Cluster Buying: A Powerful Insider Signal

A cluster buy is when three or more officers and directors buy shares of their company’s stock in the open market at varying prices. The strongest cluster buys are when they buy at higher and higher prices.

Insiders sell stock for a lot of reasons – estate planning, a big purchase (like a car or an island) and taxes… But they buy for only one reason – they think their company’s shares are going higher in the future.

Who would you trust? An insider or an outsider?

And, within insider buying, there is a hierarchy. What’s a bigger tell? A CEO buying 10,000 shares or an account executive buying 500 shares?

Insiders cannot sell shares they buy for six months without facing penalties. So when I make a pick based on insider buying, it’s not a short-term pick – usually. But we tend to bail out within a few weeks for a win anyway.

Below are two charts that will help explain this in more detail…

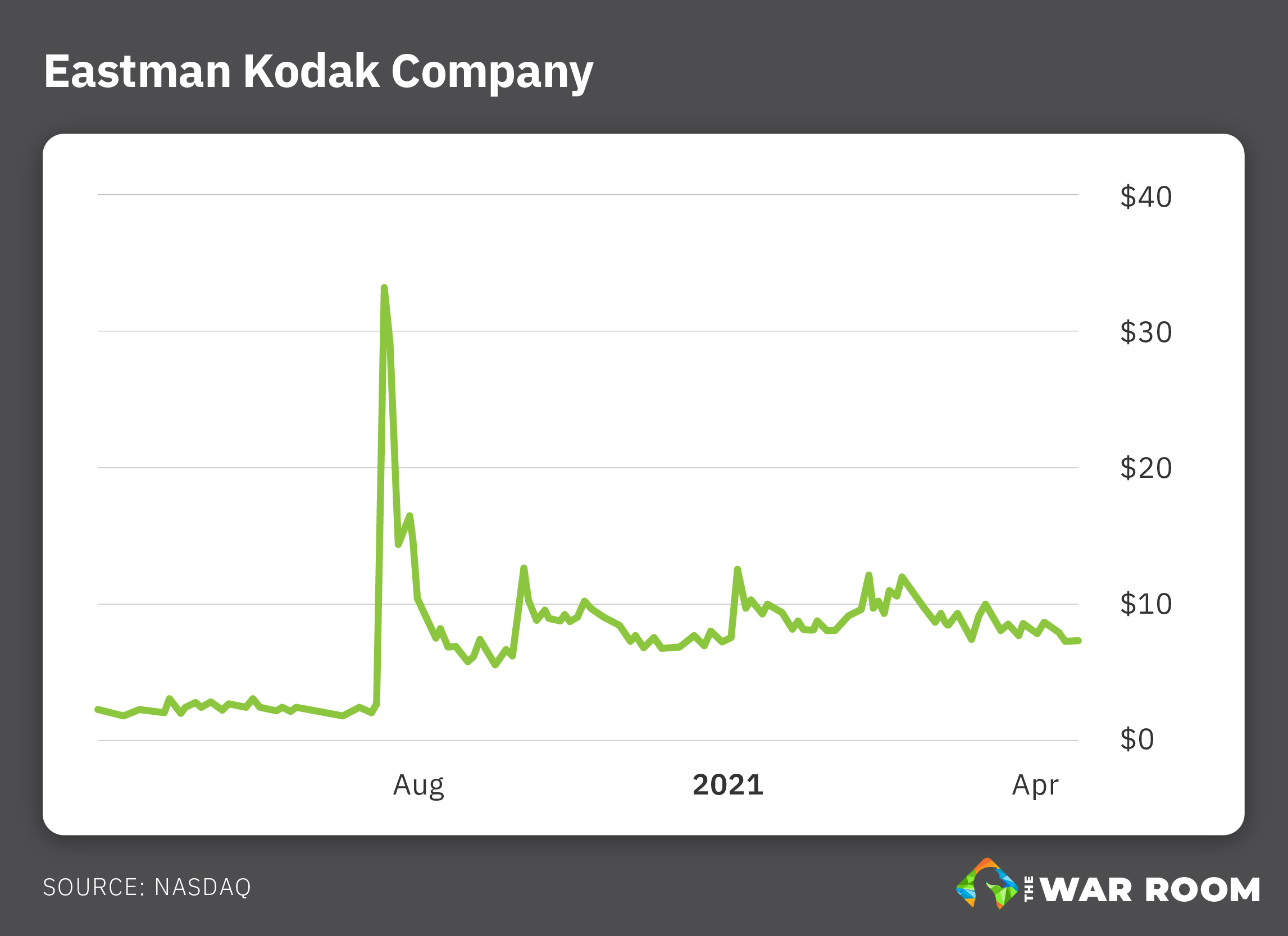

You can see in the first chart on Eastman Kodak (NYSE: KODK) that it went as high as $50 – around when the Trump administration announced it would help in the manufacturing of drugs… which occurred in the summer of 2020. Trump gave the film company a $765 million loan so it could manufacture ingredients used in pharmaceuticals. With Kodak’s expertise in making chemicals for film, its executives believed they could apply that knowledge into making chemicals for pharmaceutical drugs.

Before that announcement, in March of 2020, Kodak was trading under $2.

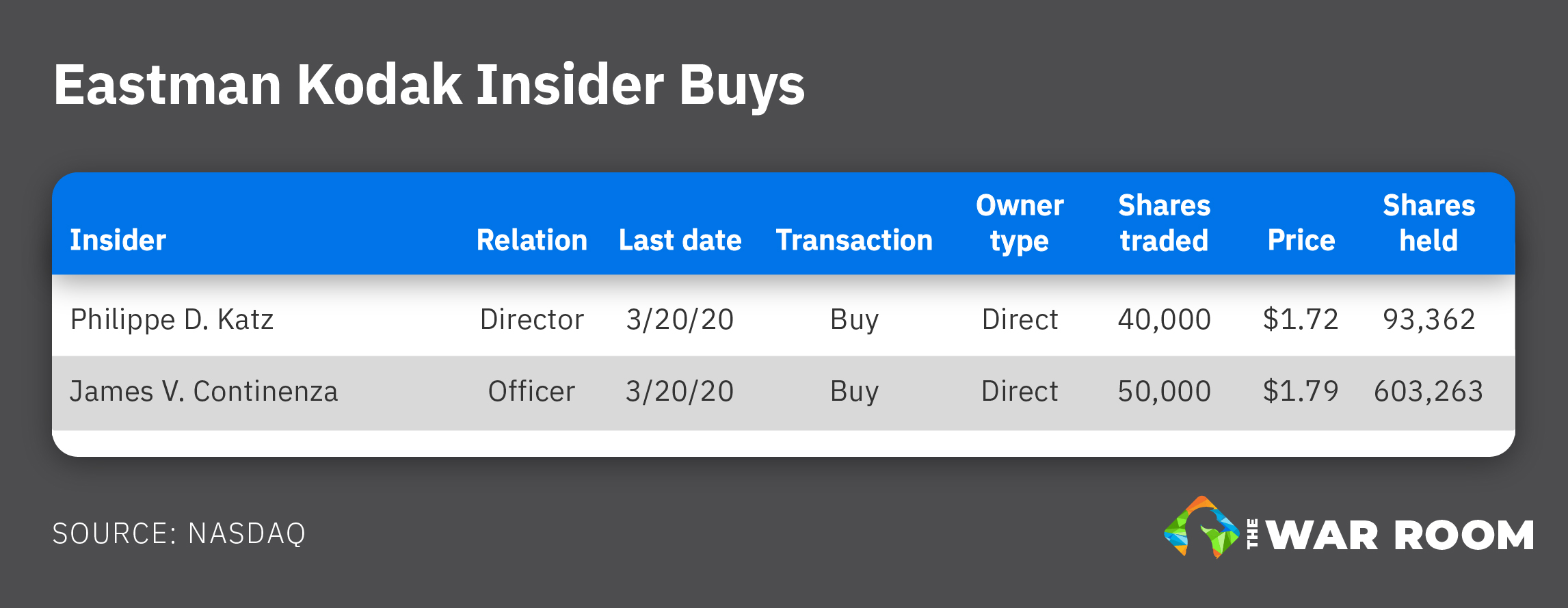

How do I know this? Because in March of 2020, a couple of insiders stepped in and bought shares (they had bought earlier too).

That’s quite a move – $1.72 to $50 in five months… Wouldn’t you agree?

That would have been good information to have, right?

Well, guess where you would have found that information?

Inside The War Room! I posted this note on March 25, 2020: “KODK – lots of insider buying on this patent play.”

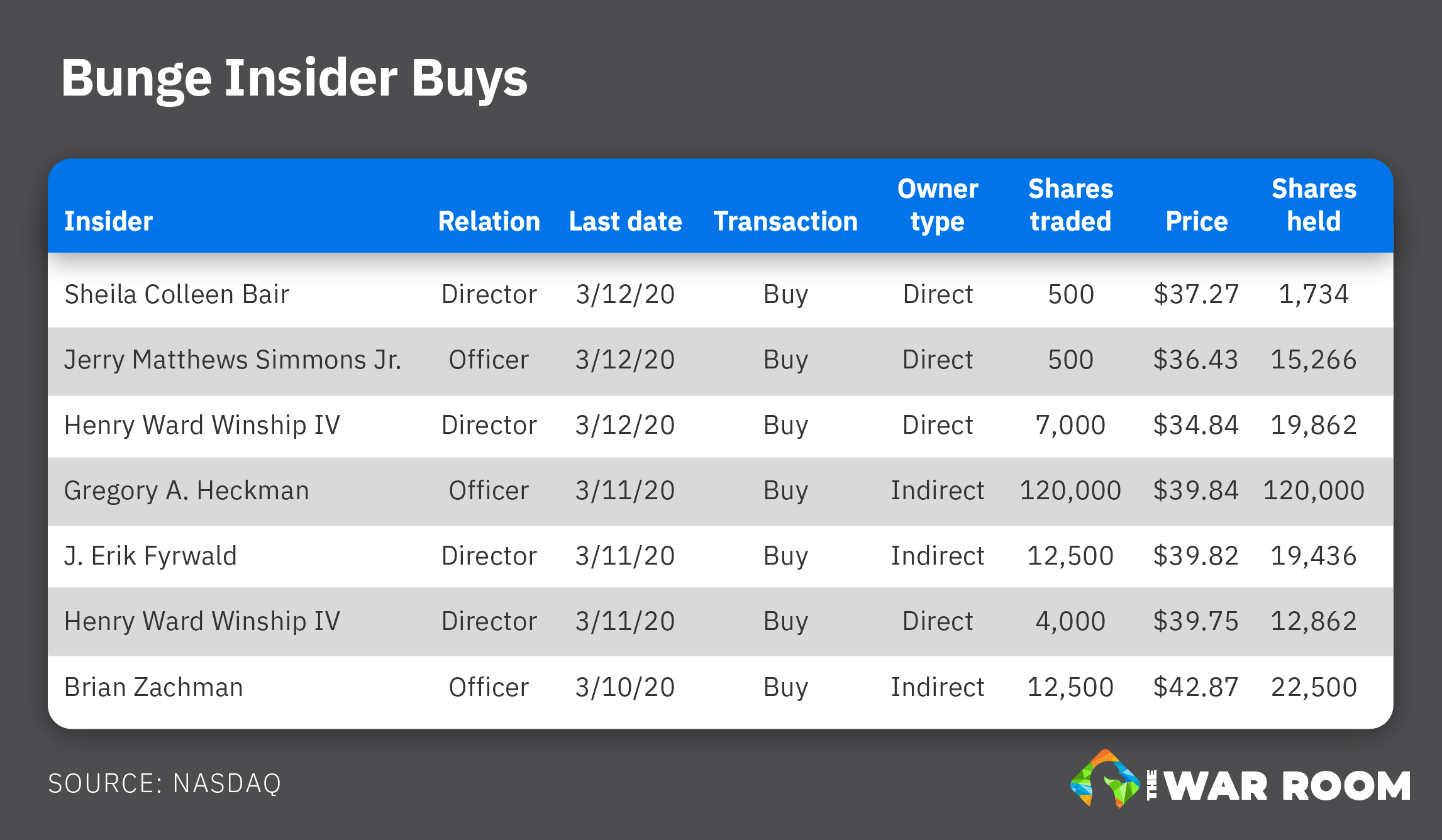

The second chart above is of Bunge (NYSE: BG). There was lots of insider buying on this one in the $30s. (It’s almost at $80 now.) Just look at those massive buys and the dates, March 10 to March 12.

War Room members bought Long-Term Equity Anticipation Securities (LEAPS) on Bunge for a 320% win! And when did they get in on this ride?

Check out what I posted in The War Room on March 13, 2020…

BG – the buys just keep coming in: BG Bunge Ltd Winship Henry Ward Iv B 4,000 39.75 159,004 10:58:14

2020-03-11

Winship Henry Ward Iv B 7,000 35.62 249,305 10:58:14

2020-03-12

These plays were insider buys, but not just regular insider buys… These were cluster buys. War Room members did the same on Party City (NYSE: PRTY), J. Alexander’s Holdings (NYSE: JAX), Bloomin’ Brands (Nasdaq: BLMN), Gannett (NYSE: GCI), AbbVie (NYSE: ABBV) and probably two dozen more!

However, there is one BIG problem with insider buying – fraud.

Sometimes insiders know that people like me are watching all of their trades. They can plant some buys from themselves and others to make it look like cluster buying, knowing it will be picked up. So that’s where fundamentals come into play. It’s more than just seeing a buy from an insider! Cluster buys do not just show up as cluster buys… You have to put it together.

Now let’s get into a longer-term strategy that has brought War Room members huge success…

LEAPS: Longer-Term Investing

LEAPS is an acronym for Long-Term Equity Anticipation Securities, as I said above. These are long-term options that expire in a year, two years or even three years.

You should use LEAPS when they are available on a non-dividend-paying stock. To me, LEAPS are a proxy for owning shares if I don’t think I will be in the position for more than a year or even more than a few months. LEAPS allow me to make mistakes and still have skin in the game.

First, a LEAPS option expiring in a year will cost about 10% of the underlying share price at the money. So if IBM (NYSE: IBM) was trading for $132 today, I could buy the IBM $125 January 2022 LEAPS from $13, or about 10%. Instead of risking 100%, I am risking only 10% of my capital and I have almost a whole year.

Extrapolate that for a minute. Say you have 20 positions with an average cost of $50 and 1,000 shares in each. That is a $1 million portfolio.

For a one-year option, I will pay 10% of the underlying share price, and for a two-year option, I will pay up to 20%. And that will determine my strike price.

Let’s say I have a $1 million stock portfolio. If the market crashes and I have no stop losses, I could lose 50% easy based on the past couple of crashes. But let’s say I use a 25% stop loss. I expect that portfolio to increase in value by 25% over the next two years. That’s a gain of $250,000, and with a 25% stop loss, my maximum loss is $250,000 as well.

The average price for at-the-money two-year LEAPS options for all 20 positions is about $7, so if I buy 10 contracts to match 1,000 shares and do it over 20 positions, I will spend $140,000. Right off the bat, I am risking $140,000 versus $1 million. That’s 14% versus 100%.

In fact, my stop loss is $250,000, so $140,000 is just more than half of my stop loss! Let’s say the market goes higher and takes my stocks along. In two years, it goes up 25%, so each of my stocks is now trading for $62.50. That’s a nice 25%, or $250,000, profit! I was risking $1 million, worst case to make that $250,000.

My LEAPS are each worth $12.50 now ($62.50 – $50 = $12.50). And my cost is $5.50 ($12.50 – $7 = $5.50). I will make a $5.50 profit on each contract. For the 20 positions, that is a net profit of $110,000. In the LEAPS scenario, I risked $140,000 and made $110,000, or 78% instead of the 25% on the stocks. And I had only $140,000 at risk instead of $1 million.

Wait, it gets better…

The $860,000 that was not in stocks is making me around 3% in cash over the two years for around $20,000 in interest, dropping my cost to around $120,000. But wait… it gets even better.

If the market corrects like it did last March, I would lose $250,000, as my stops would all be hit. But with LEAPS options that expire in two years, I would still be in the market if it recovered, as it did. Imagine owning a two-year option on Cleveland-Cliffs (NYSE: CLF) with a $7 strike price for two years. One of our members did just that, and he’s up a couple of hundred grand right now on an investment of probably around $10,000 in LEAPS.

Every time I play LEAPS, I know that my maximum loss is what I have invested, and that is likely 10% or 20% of what I had in the stock. I like those odds very much. On dividend-paying stocks, it makes no sense to use options, as you are likely owning the stock for the dividend and options owners do not get the dividends. However, you can create your own dividend by selling LEAPS calls against your dividend-paying shares to generate even higher returns.

I use LEAPS in The War Room on any stocks that have them. I play them straight, with spreads, on put sells, on covered calls… and everything else under the sun.

The next strategy is one I use to reduce my cost and trade in volatile markets, as I can always buy back a portion of the value… spread trades!

Spread Trading

Spread trades are an example of a combined trade – two options opened together in tandem as a single trade.

There are quite a few types of spreads. The most common are calendar spreads, diagonal spreads, vertical call spreads and bear put spreads. There are many more complicated ones, but these are the ones we use the most in The War Room.

Calendar Spreads

A calendar spread is a strategy established by simultaneously entering a long position and short position on the same underlying asset with the same strike price, but with different delivery dates.

For example, let’s say that Barrick Gold (NYSE: GOLD) was at $20 per share and you think it will go up, but not higher than $23 within a couple of years.

With a calendar spread, you would buy the $23 option that expired in January 2023 and sell the $23 option that expired in January 2022.

If the January 2023 call was trading for $2 and the January 2022 call was trading for $1, your cost would be $1. Your goal is for Barrick Gold to close at $23 or below. That way, you’d keep that $1 free and clear and get a chance to sell more options or just have a reduced cost. If it goes over $23, you would still make money, as there is more time value left on the $23 option that expires in 2023.

The goal of all spreads is to limit your dollar outlay. This is done by buying an option and selling another option against it – like a covered call.

Diagonal Spreads

A diagonal spread is a modified calendar spread involving different strike prices. It is my favorite type of spread.

Take QuantumScape (NYSE: QS), for example. A diagonal spread on QuantumScape would look like this…

In this case, I am buying the $45 calls that expire in January 2023 and selling the $60 calls that expire in January 2022 (a year earlier). Of course, I am betting that QuantumScape will go higher in 2022 than it will this year. But even if it goes higher this year, I will win.

The January 2023 $45 calls are $13 by $16 – so let’s say we buy those at $14.50. The January 2022 $60 calls are $6.10 by $6.80 – so let’s say we get $6.50 for selling those.

Remember, we are entering a spread. In this case, the spread is $15 ($60 – $45). The cost of the spread is $8 ($14.50 – $6.50). So our upside is $8.50 ($15 – $6.50) plus or minus if the shares go over $60 at expiration or before.

The goal is for the shares to close below $60 this year so we can own the 2023 option for $8, as the 2022 option will expire worthless if the shares are under $60 at expiration. Then we can sell more options that expire in January 2022 against our 2023 position to lower our cost further. For example, here’s where the QuantumScape $80 calls expiring in January 2023 are at with the stock at $38…

If the stock was at $45 or $40 at expiration, those options would be trading for around $8. We could then sell the $80 options and reduce our cost to zero with an upside of $35. That is the beauty of a diagonal spread.

Vertical Call Spreads: You Are Bullish

Here’s how a vertical call spread works: You buy an option at a lower strike price, and you sell an option with a higher strike price against it. It’s like a covered call, but you use two options instead of a stock and an option. The spread refers to the distance between the two strike prices.

For example, let’s say you have an option with a lower strike price that will cost you $1.35 to $1.50 to buy. You will also sell a higher-strike option for between $0.40 and $0.50. Your cost will be between $0.90 and $1 (you subtract what you get from selling the higher-strike call from what you paid for the lower-strike call). In this case, the spread is $5. So you are risking around $1 to make $5. I like using LEAPS, as these types of long-term options give me time to survive a lot of adverse events.

Bear Put Spreads: You Are Bearish

A bear put spread is similar to a vertical call spread, but instead of using calls, you use puts. With a bear put spread, you buy a put at a higher strike price and sell another put (with the same expiration date) at a lower strike price. For example, let’s say you buy a $10 put and sell a $5 put for $1. Your cost is $1, and your spread is $5. You are betting the shares will go to $5 or lower to collect the whole spread. But any move below $9 will make you money.

When you enter a spread, your account is debited money – meaning money is taken out – hence the term net debit.

When you exit a spread, your account is credited with the proceeds, hence the term net credit.

Unlike stocks, which generally have very tight spreads, options have varying levels of spreads. There are several factors that determine options’ spreads:

- The price of the option

- The time the option has left before expiration

- The amount of current activity on the option

- Which exchanges the orders are placed on by the market makers.

As a general rule, options have an “implied value” based on the theoretical price, using the price of the underlying stock and the current volatility of that option. Some brokerage firms will price the value of the option in real time using exactly this formula. And the professionals plus the machines will also know the implied value of every option they trade.

The reason for this explanation is to let you know that if you see a wide spread, it pays to “fish” your order using a limit order. Start with a conservative entry point that benefits you the most and work it through the spread to find out where the market is (if you don’t already know). Many times, you can get very close to the implied price on the options using this strategy, and it will keep you from overpaying into such a wide spread.

Always remember, don’t use a spread if you think a stock is going to the moon or is going to plunge because, in return for reducing your cost, a spread will limit your upside.

I use spreads to reduce my cost. But I also use them as a trading mechanism in volatile markets, as I can always buy back the “sold” side of the spread and make a profit while waiting for a rebound to sell another option against it. I can also close a spread early or leg into a higher strike.

Now let’s get into another core strategy used to generate income…

Covered Calls: A Two-Part Trading Strategy

You can do a covered call trade in any type of account, but the best place to do it is in an IRA for tax deferral. A covered call is basically a put sell done backward. I bet some of you did not know that and that covered calls are the least risky type of trade. A covered call is when you buy or own shares (at least 100) and sell options against those shares. You can do this with only options as well – that is called a spread.

There are three types of covered call trades: at the money, in the money and out of the money. The least risky is an in-the-money trade.

So, for example, let’s say you like Cleveland-Cliffs and you think it’s going HIGHER.

Let’s say it’s trading at $18.20 right now and you think it will be at $25 by the end of the year. You would buy Cleveland-Cliffs at $18.20 and sell to open the January 2022 $25 calls for $2.10. Your cost is now $16.10, and your upside is $8.90 ($25 – $16.10), or around 60% based on your cost.

Now, let’s say you think Cleveland-Cliffs is not going higher but will stay around where it is. You buy it at $18.20 and sell the October $18 calls for $3.30. Your new cost is $14.90, but your upside is capped at $18 (the strike price of your option) for a gain of 20% based on your cost.

Maybe you think Cleveland-Cliffs is going lower and you want to own it cheap and get a bigger downside cushion (each trade above gives you some cushion). You buy Cleveland-Cliffs at current levels of $18.20 and sell the $15 calls expiring in January for $5.50, dropping your cost to $12.70 – 30% BELOW the current price (your safety net). The return on this in-the-money covered call is 18% with a 30% downside cushion.

That last trade is similar to what I do with put selling, giving you that fat cushion and a great return as well.

When you use covered calls, you can also receive dividends, which an option seller or buyer does not get. YOU ARE A SHAREHOLDER, and that means if there is a dividend, you get it. So another strategy is to sell covered calls on dividend-paying shares to boost your return.

Now, if you already own stocks and are looking to juice your returns, you can sell calls against your shares. This is how you determine which calls to sell.

Say you own shares in Cleveland-Cliffs and your cost is $15. The most important question is this: Where would you be a seller of Cleveland-Cliffs? That gives you the strike price of the calls you will sell. If that number is $25, then sell the $25 calls. If the shares go to $25 at expiration or at any time, the shares can be called away from you (taken out of your account), but they must pay you $25.

Think about Warren Buffett, for example. He owns 400 million shares of Coca-Cola (NYSE: KO). He knows that he can always buy it back cheaper if he has to. But he may be happy selling calls on his position that are way out of the money. If he can pick $1 per share, he just pocketed $400 million for saying, “You can have my shares 20% higher than the current price,” which would be another $4 billion on top of the $400 million.

Covered calls are a great way to generate income, lower your basis in stocks you own and buy stocks for less. BUT you are a stockholder, and that means if the shares go down, they will go down for you as well. While a covered call will not protect you from a market or stock crash, it will mitigate your losses – and that is always better. So even with covered calls, you must position size and buy shares only in companies you want to own!

Covered calls are the easiest approval to get because there is zero risk to the broker – you own the stock already. Just ask for an options agreement and fill it out. Approval is almost automatic for covered calls.

The last strategy I am going to discuss is one that has generated a 100% win rate on 55 trades. This strategy is called put selling, and I have been using it since April 2017.

Put Selling: The Trading Strategy With the Highest Win Rate in The War Room

If you’re looking for one of the best-performing trading strategies in The War Room, my put-selling system is it. We’ve got a premium report on put selling in Headquarters, so be sure to check it out to ensure you understand this strategy.