Premium Report

Karim’s Spreads Tutorial

Karim Rahemtulla, Head Fundamental TacticianThe spread is the gap between the bid and the ask prices of a security or asset, like a stock, bond or commodity.

So if you wanted to do a spread on Barrick Gold (GOLD) for example, you would pick two points, let’s say $20 and $30. The spread is $10 – the difference between two points. Once you established your spread, you can place a trade. More later.

There are quite a few types of spreads. The most common are Bull Call Spreads (like we did on SDC), Bear Put Spreads, Diagonal Spreads and Calendar Spreads – there are many more complicated ones, but these are the ones we use the most in the War Room.

A calendar spread is a strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates and the SAME strike price

For example, let’s say that Gold was at $20 per share and you think it will go up but not more than $23 within a couple of years.

With a calendar spread you would buy the gold $23 option that expired in jan 2023 and sell the gold $23 option that expired in jan 2022.

If the Jan 2023 call was trading for $2 and the jan 2022 call was trading for $1, you cost would be $1. Your goal is for gold to close at $23 or below so you keep that $1 free and clear and get a chance to sell more options or just have a reduced cost. If it goes over $23 you would still make money as there is more time value left on the $23 option expiring in 2023.

The goal of all spreads is to limit your dollar outlay. This is done by buying an option and selling another option against it – like a covered call.

A diagonal spread is a modified calendar spread involving different strike prices. It is my favorite type of spread.

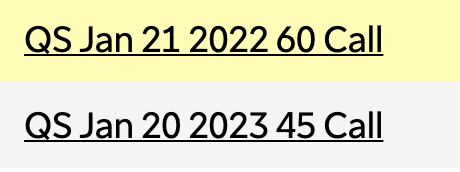

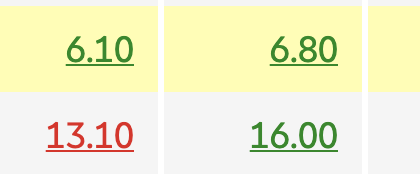

Take QS for example. A diagonal spread on QS would look like this:

In this case, I am buying the $45 calls that expire in Jan 2023 and selling the $60 calls that expire in January 2022 (a year earlier). Of course, I am betting that QS is going higher in 2022 than it is this year. But even if it goes higher this year, I will win.

The jan 2023 $45 calls are $13 by $16 – so let’s say we buy those at $14.50. the Jan 2022 $60 calls are $6.10 by $6.80 so let’s say we get $6.50 for selling those

Remember, we are entering a spread. IN this case the spread is $15 (60 minus 45). the cost of the spread is $8 (14.50 minus 6.50). So our upside is $15 minus $6.50 +/- if the shares go over $60 at expiration or before.

The goal is for the shares to close below $60 this year so we can own the 2023 option for $8 as the 2022 option will expire worthless if the shares are under $60 at expiration. Then we can sell more options jan 2022 against our 2023 position to lower our cost further. For example, the QS $80 calls expiring in Jan 2023 are at

With the stock at $38. If the stock was $45 or $40 at expiration, those options would be trading for around $8. We could then sell the $80 options and reduce our cost to zero with an upside of $35. That is the beauty of a diagonal spread. We are doing that with OPEN right now.

Vertical Call Spreads – you are bullish:

This is how a vertical spread works: You buy an option at a lower strike price and you sell a higher strike option against it. It’s like a covered call but using two options instead of a stock and option. The spread refers to the distance between the two strike prices. For example, in the upcoming trade you have a lower strike price that will cost you $1.35 to $1.50 to buy. And you will sell a higher strike option for between $0.40 and $0.50, Your cost will be between $0.90 and $1 (you subtract what you get for the selling the higher strike call from what you paid for the lower strike call). In this case the spread is $5. So you are risking around $1 to make $5. I like using LEAPS as these types of long-term options give me time to survive a lot of adverse events.

Bear Put Spreads – you are bearish:

Exactly the same concept at a vertical bull spread but instead of using cals, you are using puts. You buy a put at the higher strike price and sell another put (same expiration date) at a lower price. SO you buy a $10 put and sell a $5 put for $1. Your cost is $1 and your spread is $5 – you are betting the shares will go to $5 or lower to collect the whole spread. But, any move blow $9 will make you money.

When you enter a spread, your account is debited money – money is taken out – hence the term NET DEBIT.

When we exit a spread your account is credited with the proceeds hence the term NET CREDIT.

Unlike stocks, which generally have very tight spreads, options have varying levels of spreads. There are several factors for this,1) price of the option 2) time option has left before expiration 3) amount of current activity on the option 4) which exchanges the orders are placed by the Market Makers. As a general rule, options have an “implied value” based on the theoretical price using the price of the underlying stock and the current volatility of that option. Some brokerage firms will price the value of the option in real time using exactly this formula. And the professionals plus the machines will also know the implied value of every option they trade too. The reason for this explanation is to let you know that if you see a wide spread, it pays to “fish” your order using a “limit order”. Start with a conservative entry point that benefits you the most and work it through the spread to find out where the market it (if you don’t already know it). Many times, you can get very close to the implied price on the stock options using this strategy and it will keep you from overpaying into such a wide spread.

Always remember: you don’t use a spread if you think a stock is going to the moon or that its going to plunge because in return for reducing your cost, a spread will limit your upside.

I use spreads to reduce my cost but also as a trading mechanism in a volatile market as I can always buy back the “sold” side of the spread and make. profit while waiting for a rebound to sell it another option against it. I can also close a spread early or leg into a higher strike.