Premium Report

How to Execute Bunker Trades

Bryan Bottarelli, Head Trade TacticianWelcome to one of the most misunderstood areas of the investment market: put option trading… or what I’ve dubbed “Bunker Trades.”

This guide was written with the intention of introducing the highly profitable world of put option trading to investors who are unfamiliar with it. Put options are the easiest way to profit from a falling stock price.

Our intention is that options investors at all levels – novice, semiskilled and experienced – will be able to gain critical knowledge from this report and that this report will clear up any confusion about how to execute Bunker Trades.

When you understand how put options work, you’ll see why they can be so useful… and so profitable… particularly during the dot-BOMB thrashing headed our way.

You won’t need to identify the companies primed to crash when the new dot-BOMB bubble pops. Head Fundamental Tactician Karim Rahemtulla and I will be providing specific recommendations in The War Room.

But it is up to you to execute the trade correctly!

So if you have any doubts about how to do that… read on.

Don’t Buy the Hype… Buy the Put Options Instead

When you see a stock that’s overhyped, unprofitable and overvalued, it’s an indicator you shouldn’t invest a dime in it.

However, that does not mean that you can’t capitalize on its eventual collapse.

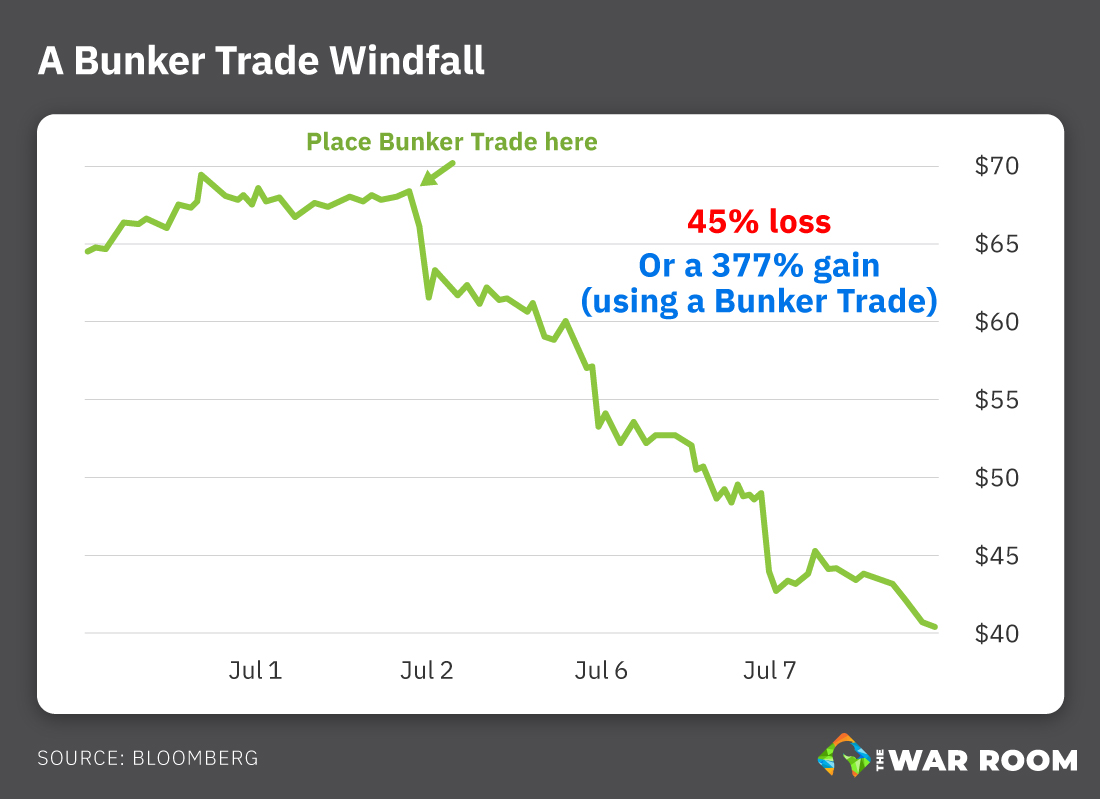

Look at the chart below. Stockholders got crushed as this stock dropped nearly 45% in a little less than a week. That’s a devastating blow.

Wouldn’t it have been nice to make a huge profit instead? Of course it would have…

And a Bunker Trade could have turned that 45% loss into a 377% gain.

Karim and I often see negative patterns develop in stocks, indicating a coming downward directional change or a possible collapse. At that point, we will run all the company’s financial metrics. That will tell us if the company is indeed overhyped, overvalued and fundamentally unsound.

If both the technical and fundamental analyses confirm there’s trouble ahead, we’ll issue a trade alert in The War Room…

We’ll give you the ticker symbol, strike price, expiration date, limit price and all the details you’ll need to find the option with whatever brokerage you’re using.

And as you’ll soon realize… placing an options trade is as simple as buying a stock. There are just a couple of extra steps.

The ABCs of Put Options

First things first…

An option is a contract, one that gives its holder the right – but not the obligation – to buy or sell 100 shares of a given stock at a specified price, called the strike price, by a designated date, called the expiration date.

It’s essentially a bet on where the share price of an option’s underlying stock will be come the option’s expiration date.

A put option is a bet that the price of the underlying shares will go below the option’s strike price and allow its holder to sell the shares at a premium. (However, we will never be exercising the option – that is, putting into effect the right to sell the underlying shares. We will always be selling the option itself to close out the trade.)

If a put’s strike price is more than the market price of its underlying stock, the option is called “in the money.” If the strike price is less than the market price, the option is called “out of the money.”

Essentially, as the stock that a put option tracks goes down, the value of the put goes up because it will allow its holder to sell the underlying shares at a price higher than the market price.

Then we simply wait, watch the stock fall and our option rise, and sell before it expires.

For instance, say we’re watching a company that trades at $10. We think its shares are very overhyped and overbought, and the company is financially troubled. Concisely, we expect the share price to soon fall.

We believe the price will drop at least 20%. So we buy $8 puts that expire one month from now for $1.

Remember, because an option contract represents 100 shares, each put option costs $100.

The share price would have to drop to $7 for us to break even. Every cent it falls below $7 would be pure profit for us.

Let’s say that company’s shares begin to sell off after an exceptionally bad earnings report. Its share price plummets to $4.

We sell our puts for $4 (the $8 puts are $4 in the money) and book a $300 profit on each option.

Executing Bunker Trades

How you execute the trade may vary slightly depending on which brokerage you’re using. However, usually the processes are very similar, because all of the trading platforms need the same information to accurately fill the order.

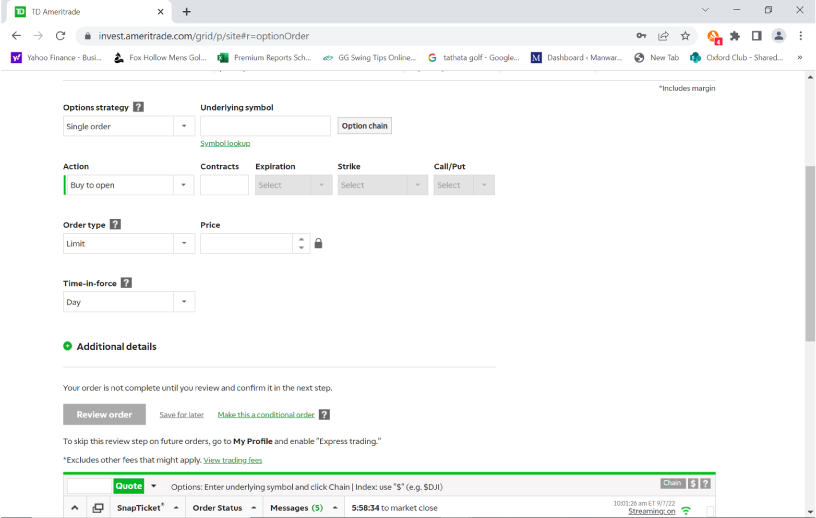

Below is a screenshot of the options trading platform at TD Ameritrade. I’ll go through each of the boxes that need to be filled in.

Options strategy: In this case, the default offering is “Single order,” which is the order type we will be using. (There is a drop-down menu – its icon is a small, upside-down triangle – that lists more complicated strategies, but you won’t need to use any of those.)

Underlying symbol: This is where you will enter the stock symbol that underlies the option you’ll be buying. We will provide the stock symbol with any recommendation made in The War Room. (If you know the name of the company but not its ticker symbol, you can look it up by clicking on “Symbol lookup.”)

Option chain: The drop-down menu here provides a list of all the puts and calls available, as well as the going bid and ask prices. We will be providing the specific option to buy, so you likely won’t need to click on this button. However, it is a useful source for current prices.

Action: On this platform, the default offering is “Buy to open,” which is what we’ll be doing when we buy a put option. The drop-down menu also offers “Sell to close,” which is what we’ll use when we close out a trade on a put option we have purchased.

Contracts: This is where you will indicate the number of contracts you want to buy. This decision is up to you. Each option contract represents 100 shares. So an option contract listed for a premium of $1 would actually cost $100 ($1 multiplied by the number of shares, or 100).

Expiration: We’ll be providing you with the suggested expiration date. The drop-down menu lists all the expiration dates. You’ll simply click on the date you want.

Strike: We’ll provide the recommended strike price. You’ll select that price from the drop-down menu.

Call/Put: For Bunker Trades, you’ll be choosing “Put.”

Order type: On this platform, the default listing is “Limit.” Typically, that is what we will be using, but if there is any variation from that, it will be made clear in the recommendation. (The drop-down menu offers any other order types we might use.)

Price: This is where you will indicate the limit price (the highest price) you are willing to pay for an option. When it comes time to sell, the limit price will indicate the minimum price you will accept to sell the option.

Time-in-force: On this platform, the default listing is “Day,” which means the trade has to be executed the day it is placed. At the end of the trading day, if the order has not been executed, it will be canceled.

Review order: After you have put in all the previous information, you’ll click this button to consolidate that information into an order. This will be your chance to review everything you’ve entered to make sure it is correct before you make the order official. An important piece of information you’ll get here is the estimated total cost of the transaction. If you decide you want to change the number of contracts, the limit price or anything else, you’ll have a choice to “Edit order.”

Place order: Clicking on this button will make it official. Your order will be sent to the exchange.

Master of the Bunker Trades

During the course of any day, Karim and I will likely be making several “Buy” and “Sell” recommendations in The War Room.

It’s essential that you go to The War Room daily to get the latest information.

It’s in The War Room that you’ll find new recommendations, updates on existing picks and information on when it’s time to sell. New recommendations are highlighted in green, updates are highlighted in blue and closing trades are highlighted in red.

By using the information in the War Room posts, you’ll find high-potential options recommendations (puts and calls). Nearly all the picks will be “good for the day” trades and will have suggested limit prices.

Options are one of the most powerful ways to leverage your stock plays and maximize your gains… simply because options are significantly cheaper per share than stocks are.

And with Karim and me helping you find trades, cashing in on options is about to become much more profitable… and a lot more probable than you ever thought possible.

Just remember to use the same key investment rules with options as you use with stocks.

Decide how much money you are willing to risk and invest only what you can afford to lose.

Diversify your holdings. Allocate your assets over several investments, using the same dollar amount in each position.

Use both calls and puts: You’ll often be surprised where the home runs come from.

But once you’ve hit a few home runs, you’ll be hooked.