Premium Report

Crash or Cash: 3 Tech Stocks That Could Either Destroy Your Portfolio or Make You 1,000%

Bryan Bottarelli, Head Trade TacticianWe’re about to see hundreds of portfolio-killing stocks crush unsuspecting investors in the days ahead.

What I’m seeing today in the markets is what I’m calling Dot-BOMB, Part II…

That’s because we have a very similar setup to the one we saw in 2000, when overvalued… overhyped… technology stocks plummeted.

Tech stocks imploded and dragged the Nasdaq index down nearly 77% during the next two years. Millions of individual retirement accounts, 401(k)s and brokerage accounts got destroyed.

If stocks in your portfolio drop 50%, 75%, 90% or more… you’d better plan to put off your retirement. That kind of loss is not easy to recover from!

When a stock drops 50%… it takes a 100% increase to get back to its BREAK-EVEN point! An 80% loss needs a 500% gain to get back to the investment’s starting value.

What these stock market losses show best is that investors need to protect themselves against big losses.

But here’s an even better solution… Turn these big stock price declines into huge profits by making “Bunker Trades”!

My research team and I have targeted three stocks that could either destroy your portfolio or potentially make you 1,000%.

Each of these stocks is overhyped… unprofitable… and overvalued.

They’re perfect candidates for buying put options.

Target Stock No. 1: DoorDash

DoorDash (NYSE: DASH) is a technology company that operates a logistics platform for merchants.

DoorDash bills itself as a company that connects merchants with consumers in the United States and internationally.

It operates DoorDash Marketplace, which provides an array of services that enable merchants to solve mission-critical challenges, such as customer acquisition, delivery, insights and analytics, merchandising, payment processing, and customer support.

However, you’re likely most familiar with the company’s flagship service: its door-to-door food delivery service.

The company’s food delivery service benefited greatly from all of the people staying at home during the height of the COVID-19 pandemic. As COVID-19 surged across the globe, food delivery surged along with it.

With no solution in sight for COVID-19, investors latched onto the idea that food delivery would be the “new normal.” And when the company reported its first quarterly profit in the second quarter of 2020… it was thought to be the first in an unending sequence of higher and higher profitability numbers.

DoorDash’s stock became the poster child for the food delivery business. The stock got hyped to the moon and became among the most popular stocks of 2021.

Time to Leave

But as the frequency and severity of COVID-19 have diminished… so have the prospects for DoorDash. People are now comfortable leaving their homes and getting out and about… including going to the grocery store.

And now, with inflation soaring, having someone deliver food to your door has become an unnecessary and costly luxury.

As a result, DoorDash’s business model has crumbled…

That first profitable quarter back in the second quarter of 2020 turned out to be the ONLY profitable quarter in the company’s history.

DoorDash continues to operate at a loss and has warned that profitability is years away…

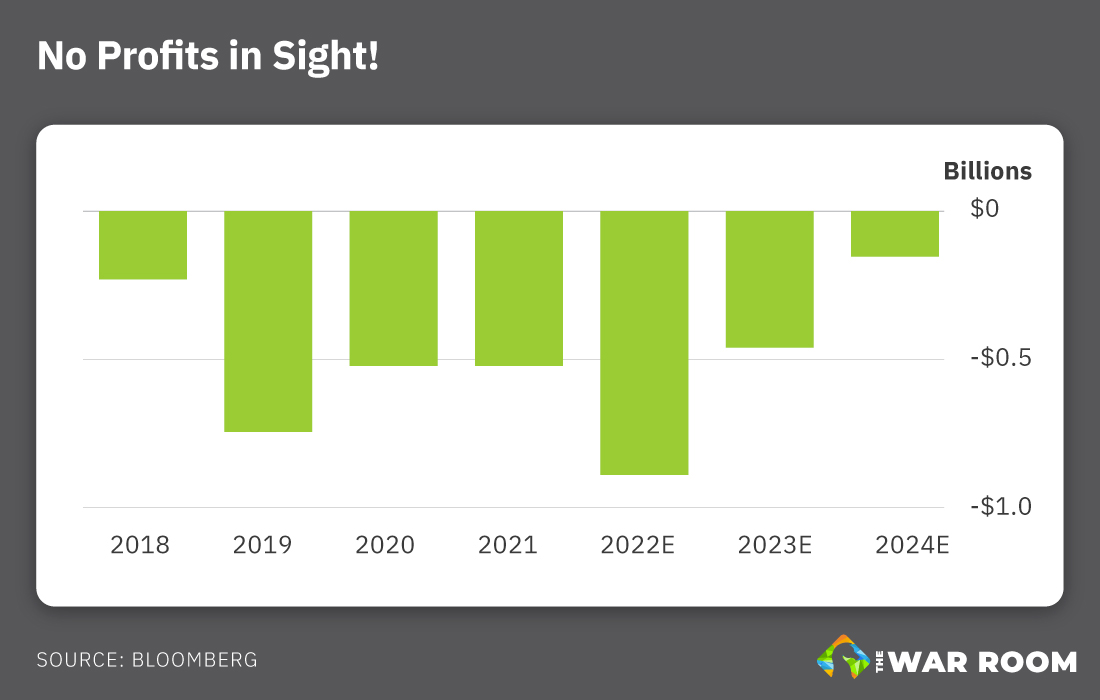

Just take a look at this chart. DoorDash hasn’t made a profit during the past four years.

Look at that 2019 bar… That’s a $667 million loss. DoorDash lost $461 million in 2020… and lost another $468 million last year. And that’s despite huge increases in revenue each year.

In 2022, the company is on a path to record its biggest loss ever, an estimated $760 million! And the company is not forecast to make any money through 2024.

The company faces stiff competition, as all food-delivery platforms are lowering their prices to win market share.

DoorDash and its competitors are also the targets of harsh government regulations. The federal government wants DoorDash (and others) to designate delivery couriers as employees instead of as independent contractors.

In addition, certain municipalities are placing caps on the delivery fees that food-delivery companies can charge.

So DoorDash has some serious operational challenges…

On top of that, its largest shareholder and multiple insiders are showing a lack of confidence in the stock. In a telltale sign of trouble, insiders and institutions are bailing out of this stock…

Japanese multinational conglomerate SoftBank (OTC: SFTBY) was previously DoorDash’s largest shareholder by a wide margin but is now consistently selling shares.

In mid-2021, SoftBank held about 54 million shares of DoorDash. But that position is shrinking. As of today, SoftBank has cut about 40% of its position in DoorDash.

If one of DoorDash’s largest shareholders is selling out of its position bit by bit, it obviously raises questions about where it thinks the business is going.

Apparently, some insiders are wondering the same thing… in the past three months, the number of sales has been triple the number of buys.

Is this stock overhyped? Definitely…

DoorDash was a stock market darling, reaching more than $245 per share back in November 2021. But the company’s business model is failing. The stock is down about 75% from that November high, but is still overvalued.

The food-delivery industry is dying, and DoorDash is the most expensive in the group, trading at a significant premium to its top food delivery competitor, Uber Eats.

And the company is not expected to turn a profit until at least 2025... long after it can realistically remain alive in a very crowded sector.

DoorDash may have been a fan favorite in 2021, but its time as a cutting-edge trendsetter is coming to an end.

Action Plan: As soon as it’s time to make a Bunker Trade on DoorDash (NYSE: DASH), we’ll give you precise, specific instructions inside The War Room. So make sure to log in every day – and be ready to receive this trade the moment the timing is right!

Target Stock No. 2: Coinbase Global

Coinbase Global (Nasdaq: COIN) provides financial infrastructure and technology for the cryptocurrency economy in the United States and internationally.

The company provides the leading cryptocurrency exchange for buying, selling and storing cryptocurrencies. More than 103 million individuals and institutions have used its services.

And because Coinbase charges a fee on transactions, that sounds like it would be a winning formula. For a while, it was…

Coinbase generated a nice profit in 2021. And the media-generated “crypto craze” sent Coinbase’s stock to the moon.

Talk about an overhyped stock… At the end of 2021, Coinbase had a market cap of nearly $55 billion.

Investor enthusiasm about the “future of money” (Coinbase’s description of cryptocurrency) skyrocketed Coinbase’s share price to more than $368 in November 2021.

But now, for various reasons I’ll explain, the bloom is off the rose.

Easy Come, Easy Go…

Coinbase’s stock downturn has been dramatic, with further to go. From its high in November 2021 to its low point, the stock plunged 88%!

Cryptocurrency adoption is not meeting the lofty expectations heaped onto it…

The vast majority of cryptocurrencies in circulation – and there are now more than 20,000 – serve no underlying purpose. They are just speculative assets.

More than 1,000 cryptocurrencies have failed and no longer exist.

Interest in cryptocurrency is fading as evidenced by the decreasing trading volume.

At its height in May 2021, the 24-hour trading volume in the cryptocurrency market was more than $500 billion. As of mid-August 2022, the 24-hour trading volume was averaging less than $100 billion.

But the huge cloud hanging over the crypto market is the specter of government regulation or an outright ban on cryptocurrency.

China made big headlines when it banned crypto last year, but it is only one of dozens of countries and jurisdictions that have either banned cryptocurrencies outright or severely restricted them over the past few years.

In all, 43 countries have implicitly banned digital currencies by putting restrictions on banks’ abilities to deal with crypto or by prohibiting cryptocurrency exchanges.

The United States is not on that list… But there’s plenty of speculation that it soon will be.

Not Making Any Coin

Coinbase reported a first quarter net loss of $430 million, or $1.98 per share, compared with its estimated loss of $0.01 per share. And this loss was compared with a profit of $771 million in the first quarter of 2021. The company said its revenue was $1.17 billion, less than the expected $1.5 billion.

The second quarter of this year brought more of the same…

Trading volume was down 53% compared with trading volume in the second quarter of 2021. Net revenue was $803 million, down 60% from net revenue of more than $2 billion in the second quarter of 2021. Net loss was $1.1 billion, or $4.98 per share, compared with a net profit of $1.6 billion, or $6.42 per share, in the second quarter of 2021.

Coinbase’s recent inability to make a profit is very troubling. But what’s even more concerning is the forecast looking forward.

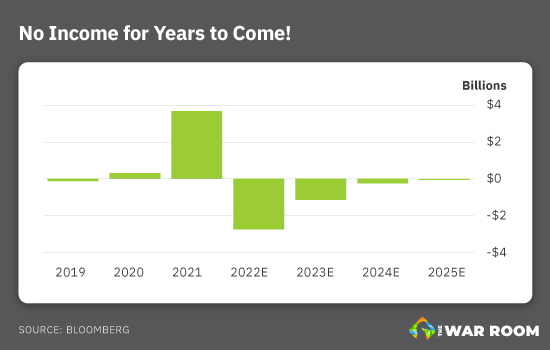

Take a look at the chart below… Coinbase is facing a bleak future. I don’t think most investors see it coming.

After a massive $3.6 billion profit in 2021, this year has been a disaster. Losses in the first two quarters of 2022 amounted to more than $1.5 billion. Look at the dip forecasted for 2022 as a whole… more than $2.5 billion. Then there’s another estimated $1.3 billion dip in 2023.

With a gigantic loss forecast for this year… you definitely don’t want to own this stock.

Coinbase is finding itself facing a major decline in trading volume… its main source of revenue. Plus, the company could – without warning – become a regulatory victim, and its very existence could be threatened by the government.

This stock was massively overhyped and is now coming back to earth as it faces serious problems.

The dot-BOMB bust, along with Coinbase’s own problems, will further weigh this stock down.

Action Plan: As soon as it’s time to make a Bunker Trade on Coinbase Global (Nasdaq: COIN), we’ll give you precise, specific instructions inside The War Room. So make sure to log in every day – and be ready to receive this trade the moment the timing is right!

Target Stock No. 3: Atlassian Corp.

Headquartered in Sydney, Australia, Atlassian Corp. (Nasdaq: TEAM) designs, develops, licenses and maintains various software products focused on helping companies perform better.

Its products include Jira Software and Jira Work Management, a workflow management system for teams to plan, track, collaborate on and manage work and projects.

Atlassian was in the right place at the right time when COVID-19 disrupted the world and the ways in which businesses operated.

Many businesses closed their physical locations, and their employees began working remotely. Atlassian’s software products made it easier for employees to stay connected.

And Atlassian’s stock became the darling of the work-from-home concept. This stock became hugely overhyped as a result of COVID-19’s impact on the global economy.

In November 2021, the stock price soared to more than $450 per share! The market cap reached nearly $100 billion, and the company had an outrageous price-to-book (P/B) ratio of 219.2.

For a company in the process of losing more than $600 million, that kind of valuation couldn’t hold up.

And it hasn’t…

The stock has retreated nearly 50% since those heady days in late 2021.

Despite the price drop, Atlassian remains very overvalued.

The company’s current P/B ratio is 176.6, far surpassing the P/B ratios of industry competitors like Asana (NYSE: ASAN) at 22.1 and Monday.com (Nasdaq: MNDY) at 7.8.

Atlassian is selling at a price-to-sales (P/S) ratio of 25.05… more than double Monday.com’s P/S ratio of 11.1… and nearly triple Asana’s P/S ratio of 8.5.

The problem for Atlassian is that there are loads of competitors in this market offering the same, or similar, products as Atlassian does.

And with COVID-19 restrictions on the decline, millions of workers are moving back into offices. The need for Atlassian’s services is waning.

That spells trouble for a company that couldn’t make money when its services were in high demand.

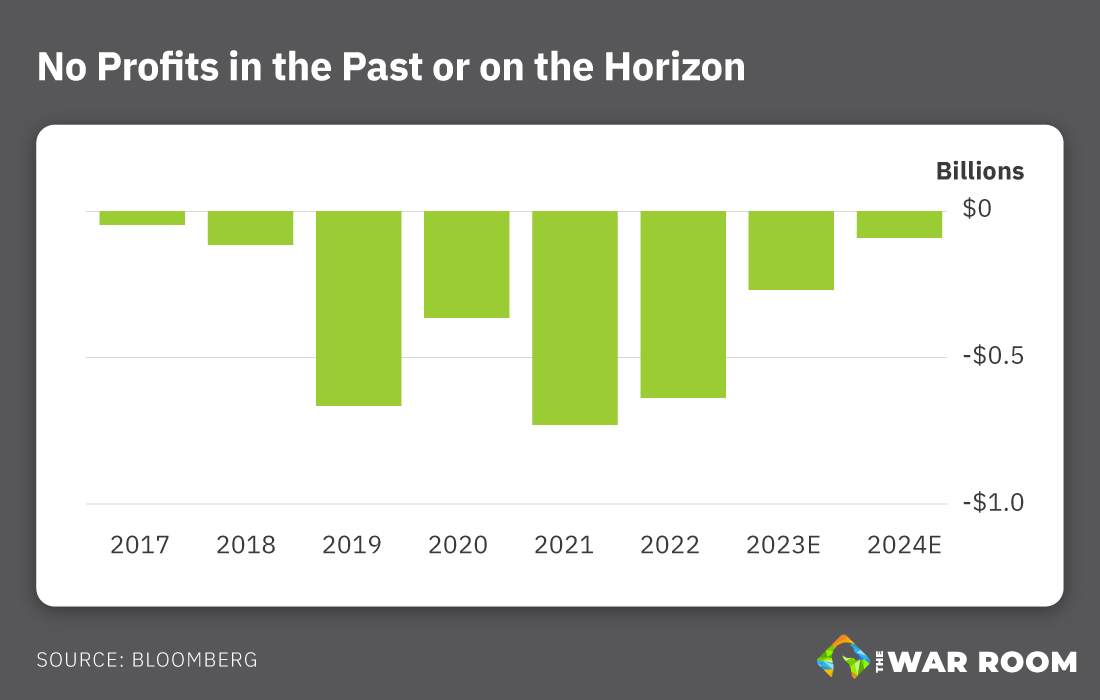

Atlassian is not making any profits… has been losing hundreds of millions of dollars per year… and is not expected to make a profit until potentially 2025!

Look at the chart below. Atlassian’s net income chart looks like it’s upside-down. There are lots of downward-pointing bars indicating loss after loss… $637 million in 2019, $350 million in 2020, $696 million in 2021, $614 million in 2022 (Atlassian’s fiscal year ends in June).

And we can see more projected losses ahead for 2023 and 2024.

Is it worth waiting 2 1/2 years for the first potential annual profit? I don’t think so, and the glamour is fading from work-from-home concept stocks.

Atlassian’s stock price has much further to fall as its valuation recedes to one similar to those of its competitors.

The looming dot-BOMB crash is not going to be kind to high-flying, perennially money-losing tech companies.

Action Plan: As soon as it’s time to make a Bunker Trade on Atlassian Corp. (Nasdaq: TEAM), we’ll give you precise, specific instructions inside The War Room. So make sure to log in every day – and be ready to receive this trade the moment the timing is right!

A Dot-BOMB Is About to Go Off… Again

These are the three trash tech stocks that I believe have the absolute highest potential to explode while also providing savvy traders the opportunity to see 1,000% returns using my strategy.

The three companies in this report will be casualties of the coming Dot-BOMB, Part II.

It will be the same story for many high-flying tech stocks… They’re about to get steamrolled.

It will hurt big-time for those folks who own the shares. Millions of unprepared investors are likely to lose huge sums of money.

But this time around, instead of suffering big-time losses, you have the opportunity to make a fortune when today’s overvalued, overhyped stocks implode.

And keep in mind, regardless of the direction of the market, you’ll have plenty of profitable trading prospects in the months ahead.

I’m so confident in my “M” pattern strategy that I’m promising to provide you 252 winning trade opportunities within the next year.

I look forward to making the next 12 months the most profitable of your investing career.

Thank you for joining The War Room.