PEV Scanner Resources

The Pre-Earnings Volume Trade Guide

The stock market can be unpredictable – even at the best of times. For the investor looking for reliable profits, it may seem like there isn’t anything to do but grin and bear the unpredictability. Fortunately, there are predictable profits to be made in any market through Pre-Earnings Volume Trades – the single best way to turn earnings releases into monster paydays. This POWERFUL strategy uses precise methodology… You’re trading based NOT on a stock’s direction but rather its movement. You see, the U.S. Securities and Exchange Commission (SEC) requires every publicly traded company to publish quarterly reports of its financial results. So, on any given day, there could be hundreds of companies publishing their earnings. Now, regardless of whether these results are good or bad, we can WIN EITHER WAY! The earnings announcements can cause big moves in the share prices of the companies that published them. And I’ve developed a four-part evaluation criteria to pinpoint ONLY the stocks poised to make the biggest moves. Once I have the small group of companies that are ripe for a Pre-Earnings Volume Trade… I write up the exact trade and share it with our trading research community. Let me break down how we will take big profits fast!

I’ve Got an Announcement to Make

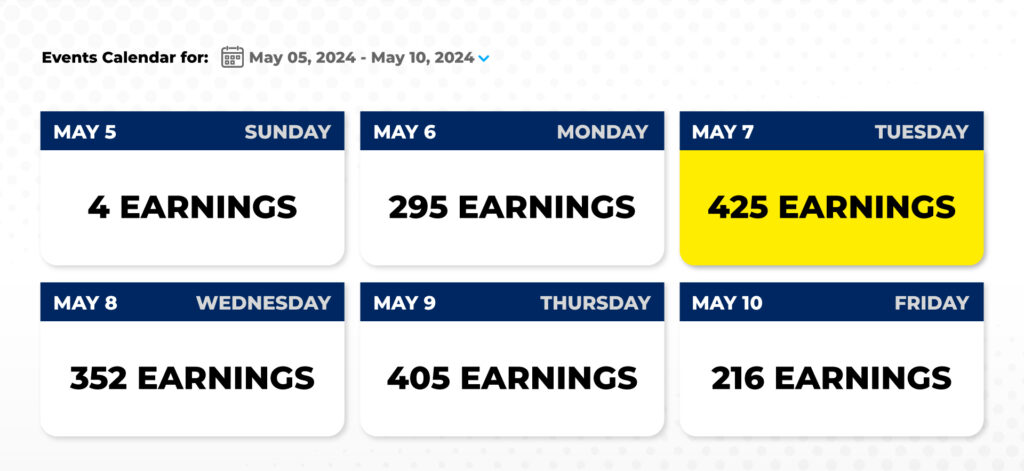

For Pre-Earnings Volume Trades to work, we need to play earnings announcements. We’re specifically looking for companies releasing an earnings report in the current week… In the Securities Exchange Act of 1934, the federal government instituted the requirement for quarterly and annual reports in the name of fairness and transparency as well as to prevent insider trading. It makes sense that shareholders in a company have a right to know how the company is doing in detail. And almost every trader knows that big moves in a stock can happen right after an earnings announcement. But most people think earnings announcements happen only four times a year, in January, April, July, and October. However, that’s just when the media focuses on the most popular companies. And that hands us one incredible profit opportunity after another… day in and day out. For example, take a look at the first couple of weeks in May 2024, a month that falls outside of what most people think of as “earnings season.” On May 6, 295 companies were scheduled to announce earnings. There were a whopping 425 companies scheduled for May 7 announcements. And May 9 had 405 companies to choose from.

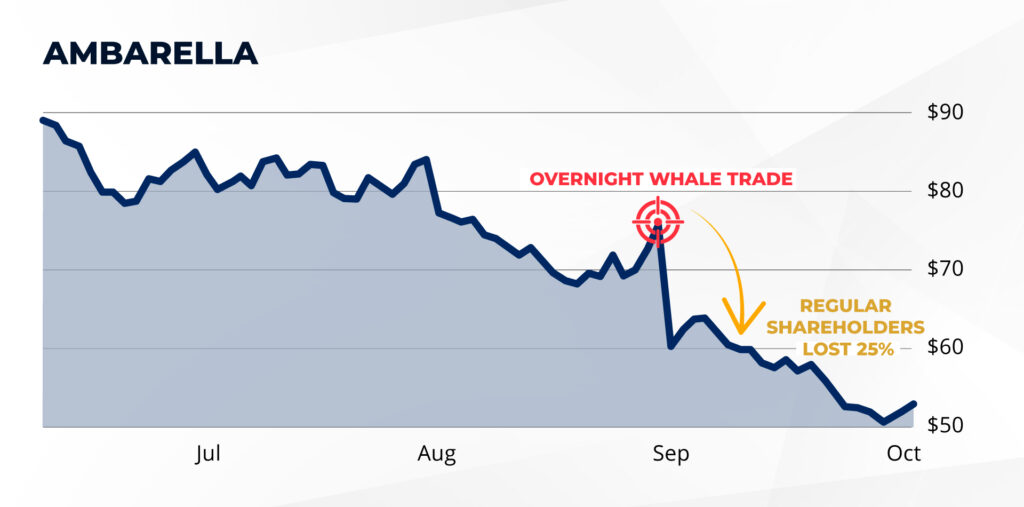

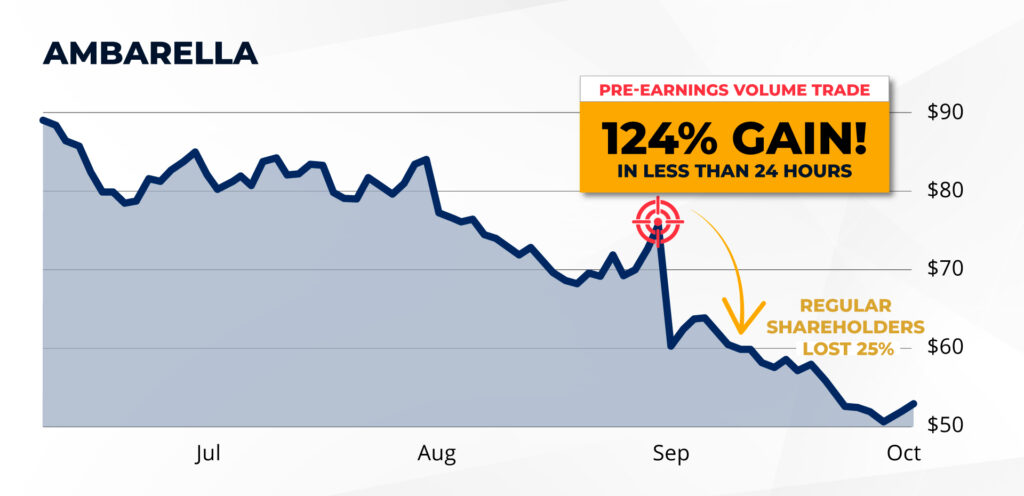

There were earnings announcements scheduled every day the market was open in May, some of them even over weekends. These earnings dates are set in stone, so we know when they’re coming and who the candidates are thanks to the SEC’s online calendar. Ambarella is a prime example of a Pre-Earnings Volume Trade – the company had everything we look for. So I recommended a special trade on it in The War Room during the trading session before the company announced earnings. The biggest moves always happen on earnings day, post-earnings release, so we wanted to place our Pre-Earnings Volume Trade the night before. Within 24 hours, the stock had dropped by 25%.

And we saw one huge 24-hour gain of 124%!

Remember, with this special trade, it doesn’t matter whether the stock goes up or down. It gives us the chance to win either way, not just on the downside. So now that we know the event we’re trading on, we need to know what to look for in the individual companies we’ll be trading…

Hunting for Volume

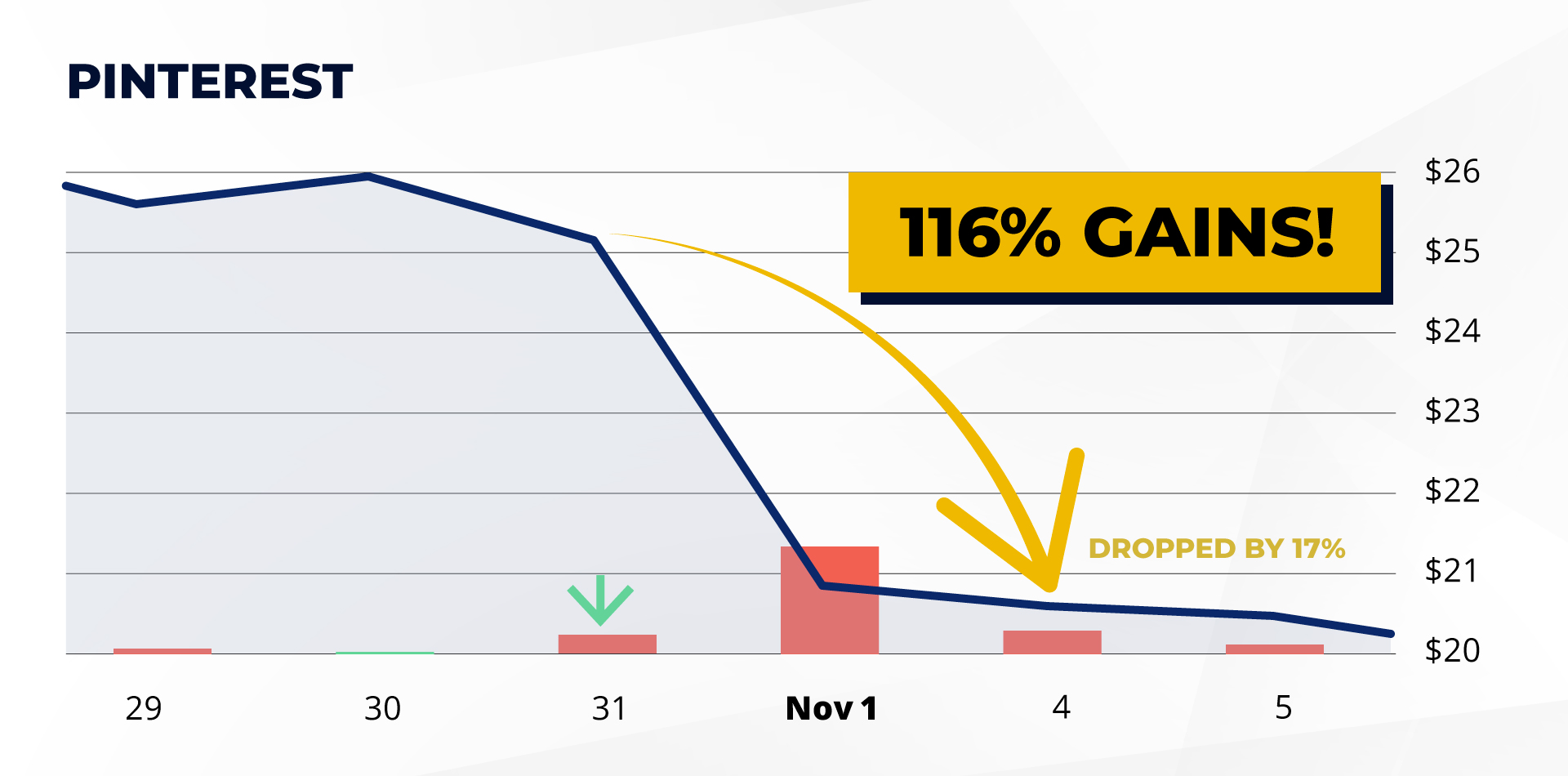

Up next are concepts you’re likely familiar with… First, we want a market cap – that is, the total dollar market value of the company’s outstanding shares of stock – of more than $2 billion. Companies that are too small are not useful for a play like this. They can move very violently and unpredictably without much pressure. Speaking of… Even more critically, we want the stock to have an average volume of more than 1 million shares over the past 30 days. This is based on the principle that greater volume means greater conviction. Volume is the number of shares of a stock being bought or sold at a given time. It’s the pressure that makes stocks do the sort of explosive movement we’re looking for. It’s a no-brainer when you think about it. After all, 1 million shares traded is obviously more significant than 100,000. Now, we’ll be using volume a little differently than traditional traders have, but the principle is the same. A large surge in volume can signal that a large move in a stock could be about to happen… Again, the common theme here is that we use a type of trade that makes money whether the stock moves up or down. It simply doesn’t matter whether shares soar or tank… So we don’t care whether the volume surge is from buyers buying or sellers selling. As long as we get a significant move in either direction… we’re golden. Increased volume represents an increased level of speculation leading into an earnings report and increases the chance of a large move, specifically the 5% up or down we’re looking for… Look at Pinterest… It was scheduled to announce earnings after hours on October 31. Right before that, its trading volume spiked over the previous day’s by 241%. That told us the smart money was pouring either into OR out of the stock. We didn’t care which direction as long as it would be a big move either way. In this case, I recommended placing our trade right as volume was spiking. Sure enough, shares of Pinterest dropped by 17%… Which is exactly what we wanted to see. Anyone who followed my recommendation in The War Room saw a 116% gain in one day.

Shoot for an ideal 200%+ increase in volume for the best odds at a trophy trade.

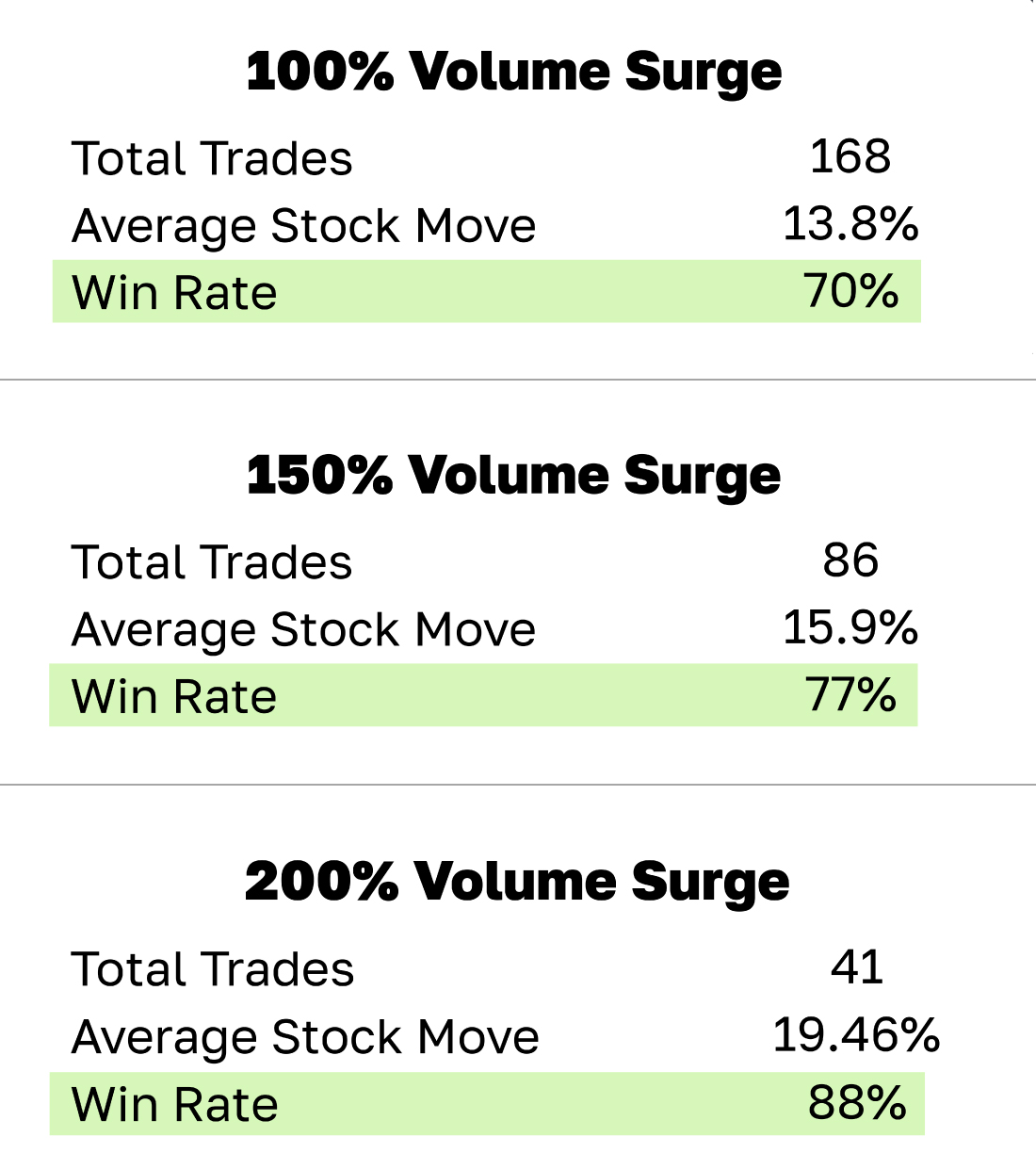

So we’re looking for a spike in volume – one that’s at least double the average volume of the past 30 days – in the session right before an earnings announcement. And volume tends to shoot up most in the final hour of trading, between 3 p.m. and 4 p.m. ET, so that’s the window we will be focusing on and when we will make our trade. Now, while we want to see at least double the 30-day average volume, the larger the surge, the greater the return. Take a look at this chart to see the difference in return between a 100% spike, a 150% spike, and a 200%+ spike – Which is the ideal . We want to place our trade the day before, because the bigger the volume spike (which is most likely to happen in the last hour of trading), the bigger the potential return the next morning when the market reacts to the earnings report. That gives us the chance for bigger gains…

But how do we identify which stocks are building momentum for the big swing we’re looking for? Well, that’s a job for our targeting mechanism…

Precision-Targeted Profits

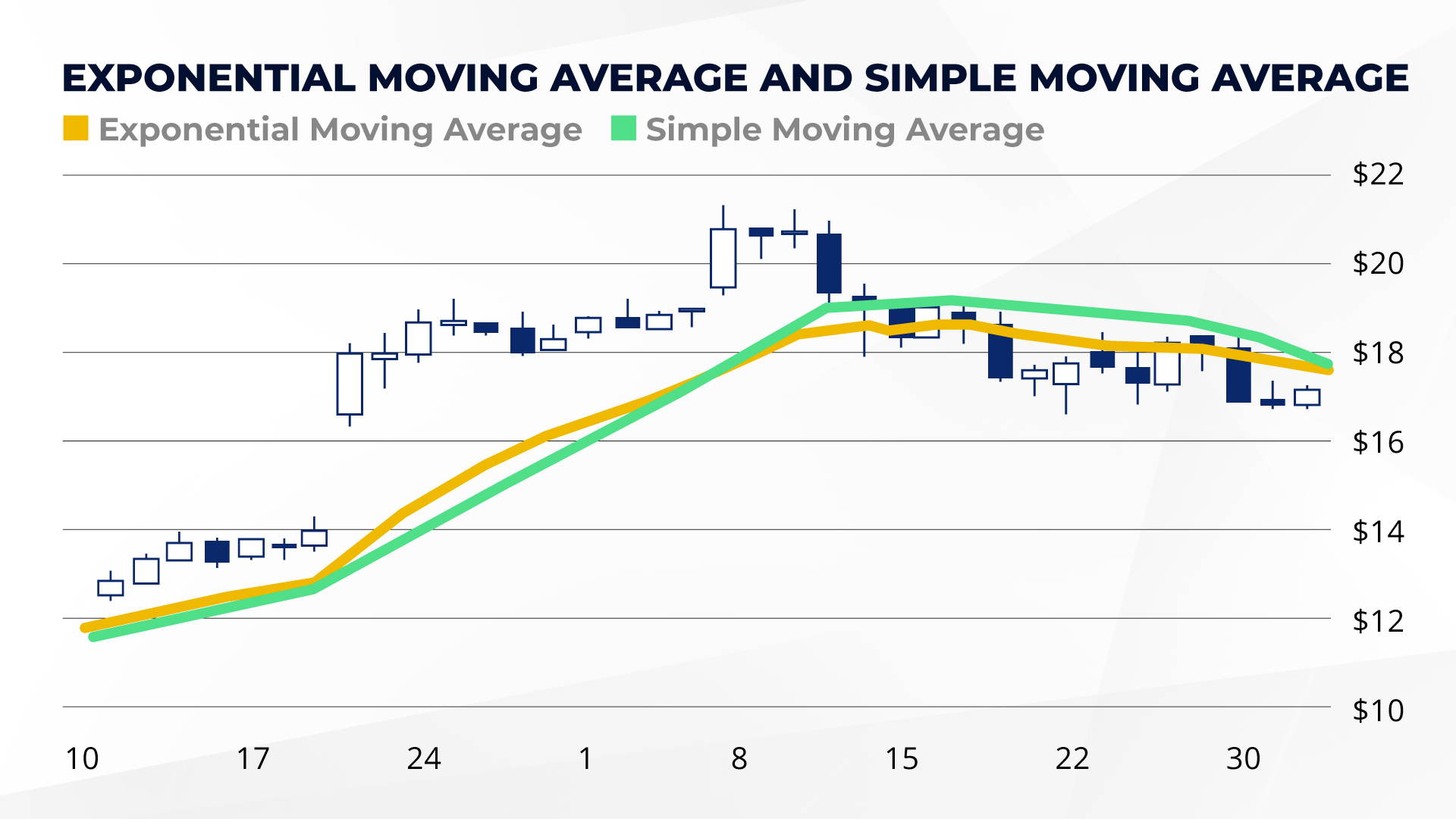

Weirdly enough, the targeting mechanism we’re using to hunt for Pre-Earnings Volume Trades was first developed by the U.S. Navy to track submarines during World War II. And later it was used to design missile tracking systems to intercept extremely high-speed objects, like satellites in orbit. We’re talking about an exercise in precision here… Because at an altitude of 124 miles above Earth, to achieve an orbit… satellites have to travel at 17,000 miles per hour. So shooting one down is like hitting a bullet with another bullet. Obviously, precision-guided missile systems need to be pinpoint accurate. The problem is that outside forces like wind or air density can push the rocket off target. At those speeds… millimeters can turn into miles in the blink of an eye. And of course, when you’re trying to hit an object traveling at supersonic speeds, the missile needs to continually adjust its trajectory. So the military needed a way to constantly steer its rockets back on target. This is called “proportional control.” And figuring it out was left up to a rocket scientist named Pete Haurlan who worked for the Jet Propulsion Lab at Caltech in the 1960s. Today, precision-guided missiles are reported to be deadly accurate, landing within 10 feet of any target. So Haurlan’s work paid off. But here’s the twist! As luck would have it… Haurlan was also interested in stocks. After hours at JPL, he would use the same system to track share prices. And that’s how we got the nine-day exponential moving average (EMA) I use as our final criterion. I call it the Tipping Point Indicator. It’s not one that many investors have heard of, but when the price of a stock lines up with it, along with a big jump in volume right before an earnings announcement, it’s a precise indicator that a big move in the stock is likely imminent. Moving averages filter out the background noise of the market using an average of prices over a specific time frame to show you which direction a stock is moving. EMAs place more weight on recent prices than older ones.

And our moving average takes into account the nine trading sessions preceding the earnings release. When the share price hits the nine-day EMA line and there’s a big spike in volume, that’s our signal. Because what happens next can be very powerful. You see, when the price and the moving average intersect, it tells me that the bulls (people buying the stock and trying to drive it up) and the bears (people selling the stock and trying to drive it down) are in a deadlock. The tug-of-war is in a dead heat, and neither side is able to make the share price move. The number of buyers and the number of sellers are roughly even, and the stock is primed for a big move the moment one side wins out. The direction of the share price is uncertain, and that uncertainty can be good for traders. And the earnings release is what’s likely to tip the scales in favor of either the bulls or the bears. What we’re looking for is a massive spike in volume, ideally of 100% or more over the 30-day average, on the day before the earnings release comes out. That’s a signal that one side is about to positively clobber the other… But it doesn’t matter to us which side wins the tug-of-war. So how are we actually going to make this trade in such a way that we profit no matter what? The answer is a play called a “strangle,” and it’s your ticket to taking massive precision-targeted gains on Pre-Earnings Volume Trades.

Stranglehold

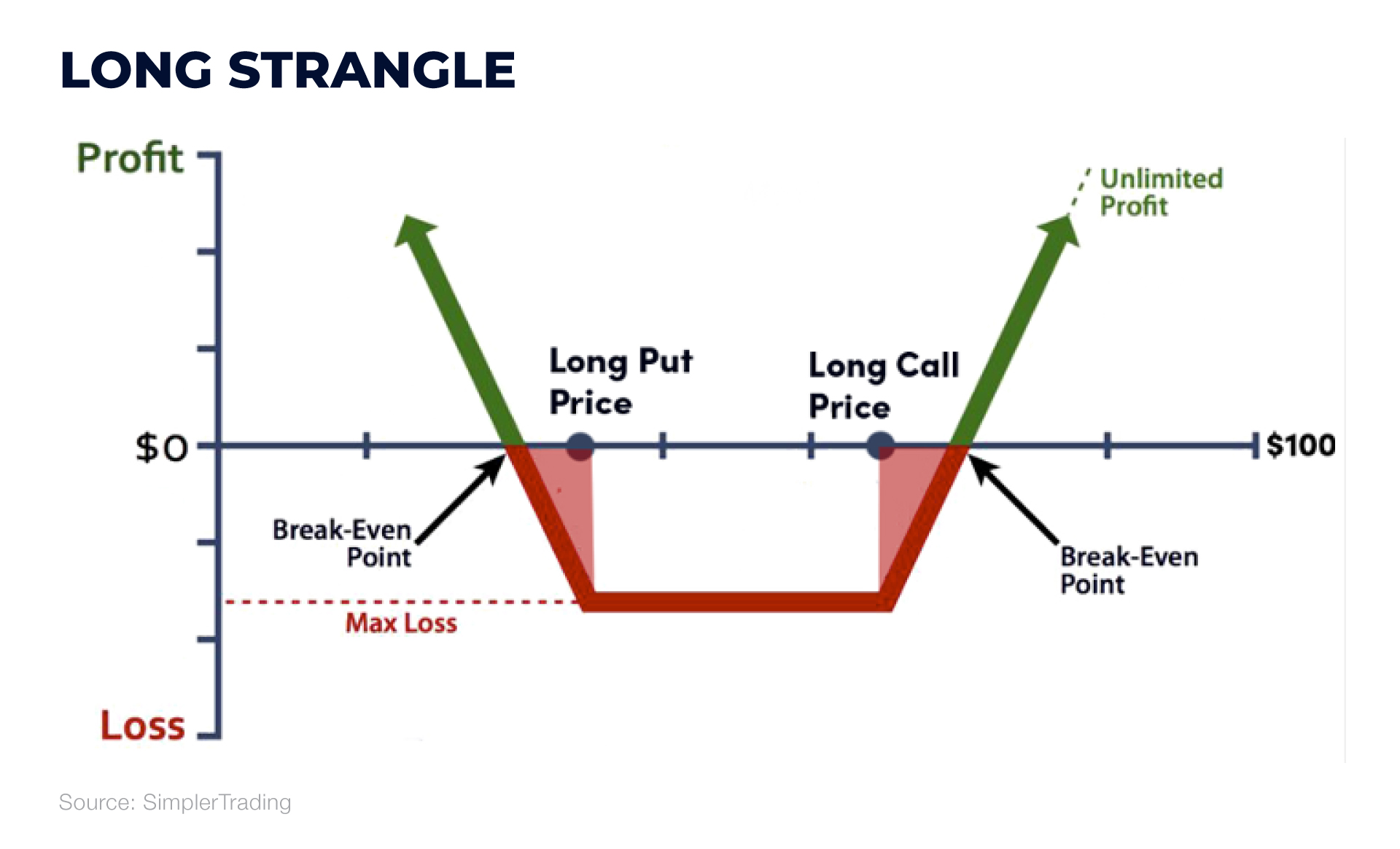

So let’s say we have a spike in volume that’s double the 30-day average on the day before the earnings release is due to come out intersecting with a nine-day moving average on a stock. How do we know what the results will be, and how do we win either way? The short answer is that we won’t know what the earnings report will say until it’s out. We can guess, but we don’t want to trade on a guess. That’s no better than gambling. So instead we’ll trade on what we know… Controlling for everything else, we know that if a stock meets the criteria I’ve already discussed in this report, it’s likely to have a big move up or down when its earnings report comes out. To capitalize on that, we will be making an earnings strangle play. In simple terms, you set up an earnings strangle by simultaneously buying an out-of-the-money call option and an out-of-the-money put option with the same expiration date and similar strike prices on the same stock. This establishes a position that theoretically has unlimited profit potential on the upside and limits any downside losses to a predetermined amount – the amount you spent on the options. Set it up correctly, and you’ll have a balanced position of calls and puts on the same underlying asset on the same expiration date, but with different strike prices. Getting positioned on both sides of a trade like this forms a strangle.

The goal is to profit from a big earnings reaction in either direction, up or down. When executed correctly, you’ll profit from a sizable earnings reaction without even knowing the direction. Here’s how that looks in practice… Let’s say that Company X is trading at $96.75 a share and is scheduled to report earnings on March 22. Its volume has just surged by more than double the 30-day average. You could establish an earnings strangle on March 21 by buying the following options. You buy Company X’s March $97 calls that expire on March 25. You also buy Company X’s $96.50 puts that also expire on March 25. Those prices are just above and below the share price at the time you set up the strangle… Now, you don’t know whether Company X will beat earnings or disappoint, but if the company’s stock moves at least 5 percentage points on earnings day, it doesn’t matter. This play will still turn a profit. And the stock has the spike in volume and the nine-day EMA we want to see, so it is likely to move much more than 5%… So, say Company X surprises with strong earnings and the stock jumps from $96 to $104, which is an 8.3% stock gain. Because of this, your calls gain 360% while your puts expire worthless. But add them together, and this trade balances out to a net gain of 130%. That’s because the substantial gain from the calls far outweighs the complete loss from the puts. You doubled your money on Company X’s earnings move without even knowing whether it would move up or down. And you’d be looking at a huge 130% gain off of a single-digit move in the share price. In sum, executing the earnings strangle has the following distinct advantages. The move: Reactions to earnings are often responsible for the largest single-day move a stock will make. And that’s precisely when you want to be involved because that’s when the money is made. The timing: You know the exact timing of every trade you’re going to make ahead of time. That’s because every earnings announcement is scheduled well in advance by the SEC. This allows you to plan your entry and exit orders accordingly. There’s zero guesswork when you have zero directional risk. When earnings season rolls around, most traders swing for the fences and speculate on only one direction, up or down. Sometimes they win, and other times they lose. But it’s always a coin flip. Over time, they’re unlikely to come out significantly ahead. But with strangles, you remove that guesswork. By playing both directions together, all you care about is whether the stock moves 5% or more on earnings day. When done correctly, as long as the stock moves up or down that much, you’ll win. In the process, your chances of success will increase significantly. Even factor in some earnings clunkers, and the likelihood of 100%, 150%, or even 293% returns remain in your favor.

Win Both Ways… in Any Kind of Market

With Pre-Earnings Volume Trades, we can take home wins daily on earnings reports no matter which way they cause the stock to move. And thanks to the SEC and earnings releases coming out all the time, you’ll have ample opportunities to take advantage. It’s as close to a sure thing as you can find in any market, especially in a market as volatile as the one we’ve had the past few years. This guide and the strangle plays we’ll be using to profit from earnings releases are excellent tools to have in your back pocket as we move forward into whatever the market has in store for us in 2024. It represents the single greatest trading advantage in the stock market, and now that you have the strategy spelled out in this guide and understand the earnings calendar, you’ll be ready to trade target stocks on the specific dates they’re most likely to generate profits. But here’s the best part… I’ll do all the heavy lifting for you! That’s right. I will be tracking the Pre-Earnings Volume Trades every day the markets are open. If any stock about to announce earnings meets my criteria, I will issue a new trade right inside The War Room – always in real time. The trade will also get delivered to you via email, so you can see my exact instructions on the go. You can, of course, go out and look at the hundreds of upcoming earnings announcements yourself. As you saw in the calendar example above, hundreds of companies could be announcing earnings on any given day. But rest assured… I will be doing the hunting for you every day the markets are open. So there’s no need for you to track all the setups and potential trades on your own – or at all. I’ve got your back there. To get started, just log in to The War Room here… Our very next Pre-Earnings Volume Trade could be today.