Post-Market Profits

Fed Shockwave: 5 Sectors Poised to Benefit From the Fed’s FOMC Announcement

Since Trump moved back into the White House…

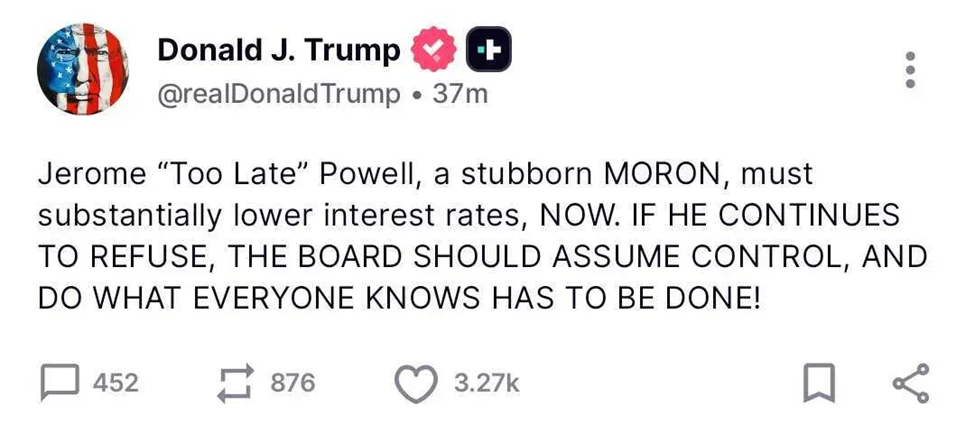

The Federal Reserve has been under pressure like never before to reduce interest rates.

The drama between President Donald Trump and Fed Reserve Chairman Jerome Powell has reached a boiling point…

And finally… Powell has caved.

But this isn’t your average, run-of-the-mill rate cut.

Yes, we’re seeing worsening job numbers… August came in a just 22,000 new jobs… and the past 12 months were revised downward by nearly 1 million. That’s the largest downward revision on record.

But inflation is ticking higher (August CPI just jumped 0.4% in one month – that was double July’s reading)… and a weakening dollar (down 11% in value in the first half) won’t help with that.

The S&P 500 has been on a bullish tear… up around 25% since the tariff lows in early April.

But 46% of the market’s valuation comes from the tech sector. That kind of weighting is dangerous.

Add it all up… This is not a normal environment for a rate cut. And the next 90 days could prove critical… and volatile… as all of these disparate forces converge.

We could see a “Shockwave” across the markets… days of sudden surges and drops… sentiment that could turn on a dime either way…

But that doesn’t mean you need to run and hide. In fact… trading volatile periods is what we at Monument Traders Alliance do best.

And that’s why we’ve put together this report of sectors and tickers you can use to profit from this unprecedented time in the markets.

So keep reading for the five sectors to watch as the “Fed Shockwave” begins…

1. Gold: The First Responder to Rate Cuts

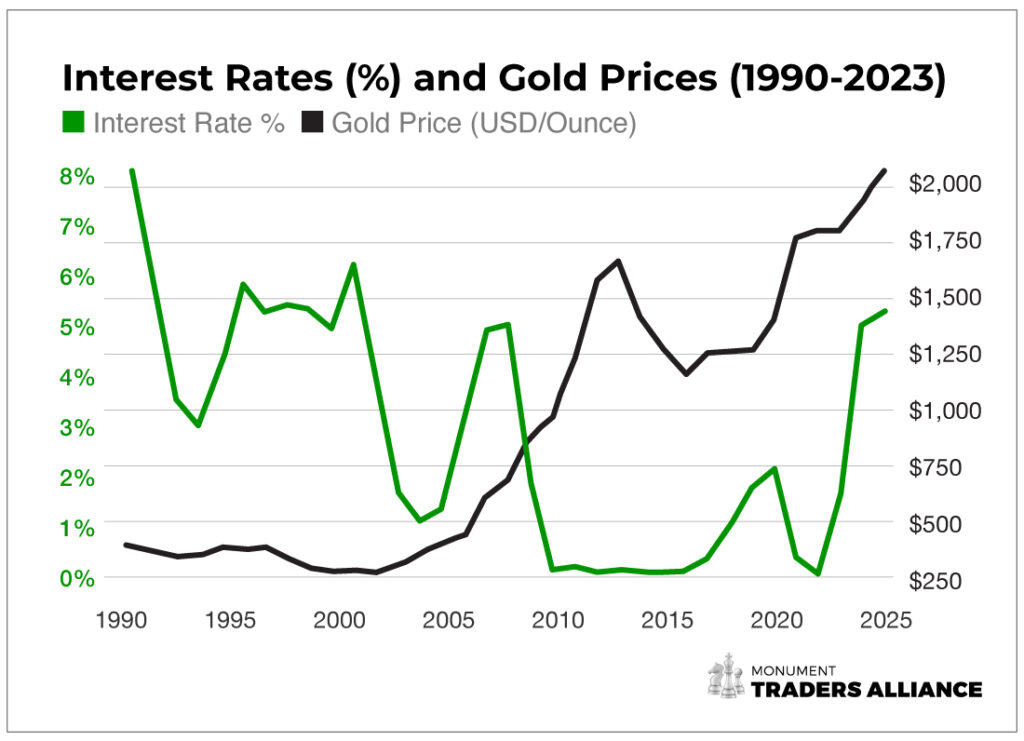

When the Fed cuts, the dollar tends to soften. That instantly boosts gold, the ultimate store of value.

Over the last 40 years of rate-cut cycles, data shows that gold has, on average, seen a 11% increase in the year following the first rate cut of a new cycle.

For example, gold surged as a safe haven during the 2007-2009 Great Recession, a period marked by Fed rate cuts and fears of a prolonged economic slowdown.

Another more recent example was the Post-2019 Pivot. That’s when the U.S.-China trade war led the Fed to cut rates in 2019, weakening the dollar and boosting gold prices. You’ll see those spikes in the chart below.

With gold sure to be on the rise… there could be opportunities with the SPDR Gold Shares ETF (GLD) or miners like Newmont (NEM) and Barrick (GOLD). These stocks often move before the headlines filter through to broader markets.

2. Homebuilders, Lumber, and Housing Plays

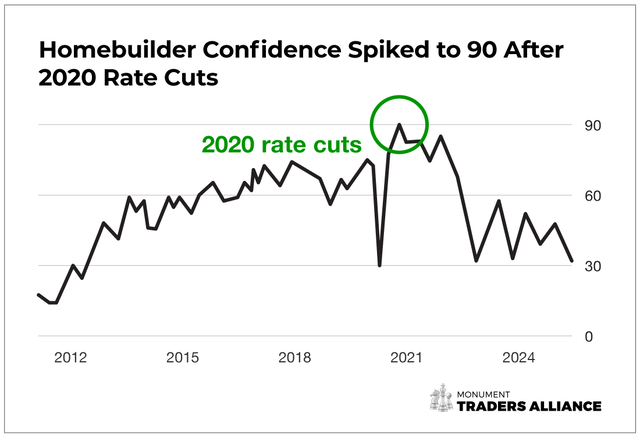

Let’s take a look at the housing sector. Historically, rate cuts pull mortgage rates down (even though mortgage rates are based off the 10-year Treasury). Lower mortgage rates provide fuel for the housing market.

They also provide lower borrowing costs for homebuilders, making it cheaper to finance new projects and refinance existing debt.

The historically low interest rate set by the Fed during the COVID-19 pandemic fueled a massive demand for housing. The National Association of Home Builders Housing Market Index reached an all-time high of 90 in November 2020 (chart below).

Anticipation of future Fed rate cuts drove a strong rally in homebuilder stocks in 2024, even before the cuts took place.

In September 2024, Reuters reported that major U.S. homebuilders saw stock increases of 1% to 3% after a Fed rate cut, with the S&P 500 Homebuilding Index gaining over 30% that year.

Here’s what to watch in the Fed Shockwave…

Lennar (LEN), DR Horton (DHI), and PulteGroup (PHM) all thrive when mortgages become cheaper. The raw material side gets a bid too. Lumber futures and producers (WY, LPX) rise on expectations of higher demand. Also,track the iShares US Home Construction ETF (ITB). It tends to spike on rate cuts and often outpaces the S&P in the weeks that follow.

3. Commodities

When central banks cut interest rates, commodities become more appealing to investors. Unlike stocks and bonds, commodities don’t pay dividends or interest. So when rates fall and traditional investments offer lower returns, commodities start looking better by comparison.

Rate cuts also tend to weaken the dollar, which is important since most commodities are priced in U.S. dollars. A weaker dollar makes commodities cheaper for buyers around the world, boosting global demand.

At the same time, lower rates often spark worries about inflation down the road. When investors expect prices to rise, they naturally turn to commodities as protection. Historically, commodity prices have climbed alongside general inflation, making them valuable portfolio hedges. This defensive buying can create steady upward pressure on commodity markets.

The main goal of rate cuts is to jumpstart the economy by making it cheaper to borrow and spend. This economic boost translates into real demand for commodities. Factories need more metals, construction projects require more materials, and increased business activity drives up energy consumption.

As the economy gains momentum from easier credit conditions, the basic supply and demand forces that drive commodity prices often shift in favor of higher prices.

Here’s your Fed Shockwave commodities watchlist: Exxon Mobil (XOM), Chevron (CVX) and ConocoPhillips (COP).

4. The Big Rotation: Tech Out, Staples In

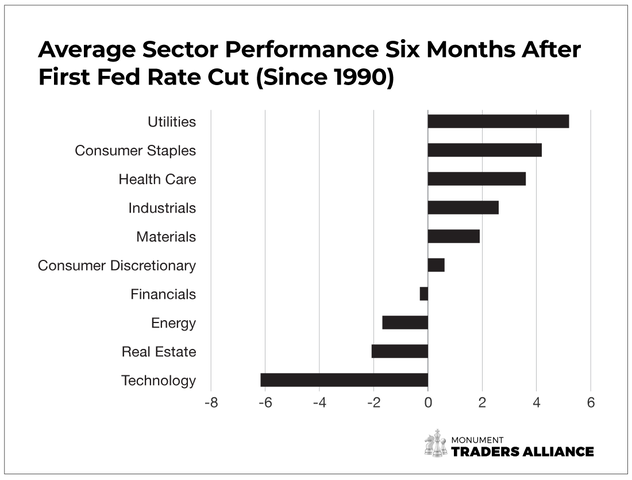

Here’s a less obvious trade to watch in the Fed Shockwave… defensive stocks.

Tech companies are valued on future earnings streams. When interest rates drop, their financials improve – but in the face of rate cuts capital often rotates into sectors with more immediate stability, such as consumer staples.

Below you’ll see a chart of the average sector performance vs. S&P 500 six months after the first Fed rate cut since 1990.

Notice how utilities and consumer staples rank near the top in terms of relative return… and real estate and tech are near the bottom.

Source: Nationwide

So pay attention consumer staples such as Clorox (CLX), Kimberly–Clark (KMB), and Procter & Gamble (PG). These “boring” names become capital magnets when investors want safe cash flow in a shifting economy. Also, keep an eye on the Consumer Staples ETF (XLP).

As you saw in the chart… you’ll want to keep a close eye on any allocation tomega-cap tech stocks (think Magnificent 7), as they can underperform in the short-term as investors reallocate.

5. Small Caps & Biotech: The Explosive Side of Rate Cuts

Finally, let’s talk about where the potential for massive gains becomes possible.

The biggest beneficiaries of rate cuts are small caps. I’m talking about companies with less than $2 billion in market cap.

Rate cuts lower borrowing costs for companies that rely on debt to fund growth – like small caps. Often strapped for cash, these companies suddenly look a lot healthier.

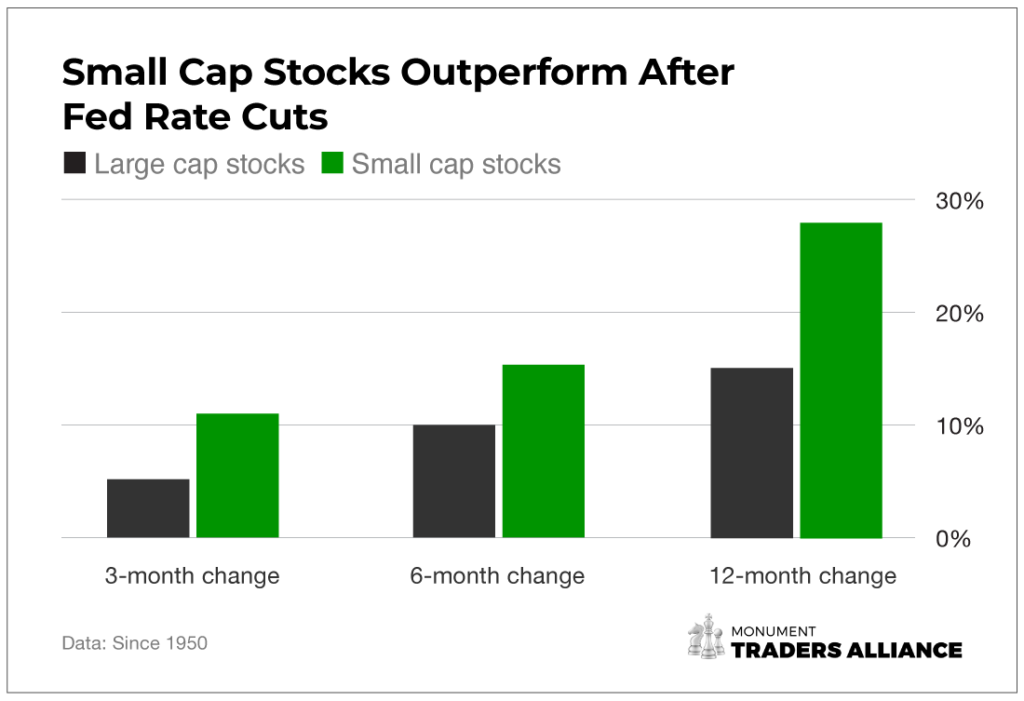

As you’ll see in the chart below, small cap stocks have historically outperformed large cap stocks after the first Fed rate cut in a cutting cycle, with gains of 11%, 15%, and 28% at three, six, and 12 months, respectively.

And what happens when you combine rate cuts with small cap biotech firms? The potential for explosive growth.

Biotech stocks tend to get an even bigger boost because many biotech firms are “pre-revenue,” meaning they burn through capital. Cheaper debt extends their runway and magnifies their future earnings potential.

After the Fed’s 2019 rate cuts, biotech indexes like the Nasdaq Biotechnology Index (NBI) outperformed the S&P 500 by a wide margin into early 2020 (before the COVID crash).

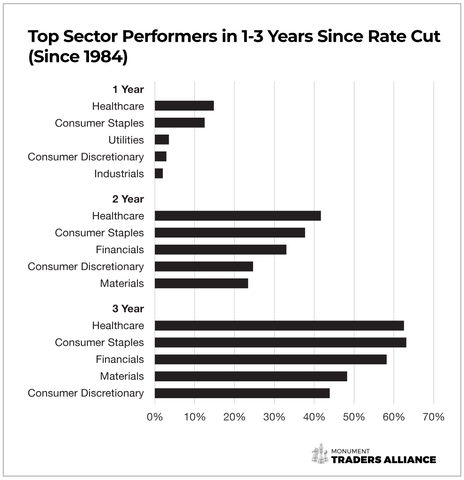

As you’ll see in the chart below (dating back to 1984), healthcare has been the leading sector performer one to three years after a first interest rate cut.

Tickers you’ll want to watch include Biogen (BIIB), Amgen (AMGN), Gilead Sciences (GILD), Regeneron Pharmaceuticals (REGN), and Vertex Pharmaceuticals (VRTX). They are all names with solid fundamentals, strong pipelines, or catalysts that could make them ride the tailwinds of a rate cut.

The Fed Shockwave Blueprint

The Fed Shockwave is just the beginning.

The next three months could be the most volatile we’ve seen this year… perhaps the most volatile in years.

But… there’s a secret strategy for turning the upcoming volatility tsunami…

Into the chance at HUGE gains.

Just recently, a major change radically altered stock market investing forever.

In short, a special trading symbol – something we call the “Dark Ticker” – is now available to regular investors.

This powerful Dark Ticker can do something almost no other ticker symbol can do.

It was granted a special privilege to trade in a 15-minute after-hours window from 4 p.m. to 4:15…

And for the first time ever, YOU can access this specialized after-hours investment for the chance at substantial overnight profits.

On Wednesday, September 24, at 2 p.m. ET, legendary CBOE trader Bryan Bottarelli will reveal how to use this Dark Ticker during the Fed Shockwave.

And YOU are on the list.

He’ll reveal the exact ticker symbol…

Plus the one simple trigger that preceded a Dark Ticker surge with 88% accuracy…

And how the next 90 days of the Fed Shockwave could give us the BEST chance at the next potential 157% overnight gains.

He’ll show you all the data… including his real trades…

And how the Q4 Dark Ticker trades could have taken $5,000… and created $25,000 in profits.

Plus… why this Q4 could have the biggest gains yet.

This could change your portfolio’s performance this year…

So don’t miss the Fed Aftershock Summit… Wednesday, September 24, at 2 p.m. ET!