Premium Report

Insider Matrix Cheat Sheet

Karim Rahemtulla, Head Fundamental TacticianIn my 35 years of experience in the market, I’ve seen it all – from the neon-drenched Reaganomics era of the 1980s to the COVID-19 crash of 2020.

And everything you’ve heard about is true…

Yes, even the cocaine and strippers.

But one spot where Main Street’s perception doesn’t match up with Wall Street’s reality is insider buying.

The term probably conjures up images of Martha Stewart in the joint with Snoop Dogg, but the reality of insider buying is that it’s mundane. It happens all the time.

It’s a perfectly legal practice, and it’s the best indicator for traders, bar none. And this report is your guide to taking advantage of insider buying to maximize your gains and make the most of the markets.

Why Insiders?

Insider buying is simple psychology, nothing more. How could someone who knows all the inner workings of their company not take advantage of that in the market?

Investing legend Peter Lynch said, “Insiders might sell their shares for any number of reasons, but they buy them for only one: They think the price will rise.”

And in simple terms, that’s why following insiders is so powerful. They know more about the companies they run than anyone else. Even market analysts don’t have access to the data company insiders do.

For instance, they know when new products are hitting the market, the trajectory of sales since the last quarterly or annual report, and the status of any ongoing merger and acquisition negotiations.

If they think the information they have access to will drive the share price of their company’s stock to the moon, they’d be stupid not to use that. Luckily, we can use it too.

If an insider buys shares in their own company, you can be sure they know something that you don’t and they think it’s good news for their shareholders.

At the end of the day, words are cheap. If you want to maximize your returns, stop listening and start watching. After all, sometimes executives say one thing and then do the exact opposite. Look no further than Elon Musk and Tesla (Nasdaq: TSLA)…

Musk has made many controversial statements about Tesla’s share price over the years. Perhaps most famously in 2017 when he said its shares were too high at $330. To say investors were spooked would be an understatement.

Tesla’s shares dropped 10% on the day in the ensuing panic.

But Elon Musk did the opposite of what you’d think after a statement like that. He continued buying and stocked up on $25 million worth of shares that same year. Tesla shares are up by a factor of four since then.

And Musk is just one example of an insider saying one thing and then doing the opposite. It’s a perfect example of why you should ignore the headlines and especially Twitter. Instead, focus on what people are doing.

Fortunately for us, insiders are legally required to tell the public whenever they buy or sell shares of their own companies…

Money Talks… Let’s Listen

Within 48 hours of making a trade, an insider must file a Form 4 with the Securities and Exchange Commission (SEC). Every single one of those forms is put in a database and is publicly available on the SEC’s website.

There, the SEC lists the name of the executive, their company, how many shares they bought or sold, and at what price they bought them.

The database might seem intimidating at first, but once you know what you’re looking for, it won’t be so scary.

First, we can ignore all the insider selling. While insider selling can be a sign of rough times on the horizon, we need much more context to be certain. An insider could be liquidating shares to buy a new car, buy a house or even something as routine as pay taxes.

Again, insiders buy shares of their own companies for only one reason…

They know something big is coming down the pike that could cause those shares to skyrocket in value. They might not have an exact date of when that something will happen, but they do know their shares will go up when it does.

But not every single one of those purchases is important. We want to see insider buying, yes, but buying in size. And we want several insiders buying in size too, all around the same time. I want to see at least two or more executives buying shares in size on the open market chronologically.

This means they’re buying thousands upon thousands of shares on the open market with real money one right after another.

They’re putting their money where their mouths are, so to speak. And that money has to be in the tens of thousands, if not hundreds of thousands, of dollars…

And not just any insider will do. We can ignore middle managers and the like. They have to be a high-ranking executive at the company, and not a director either. They have to earn their money. That said, I do want to see some director buys, but the officers are much more important.

In simpler terms, I’m looking for a cluster of insiders all buying around the same time.

In all, I want to see at least five insiders buy shares in size before I look at the company. If only three or four insiders are buying, I want to see a lot of size and executive participation. Now let’s take a look at a few examples to illustrate how this works in practice…

Sometimes the underlying company isn’t doing well, and a cluster of insider buys marks it as a potential turnaround candidate. That’s the most dangerous kind of insider buy, and trading on it is very speculative. The risk is great, but the returns can also be phenomenal.

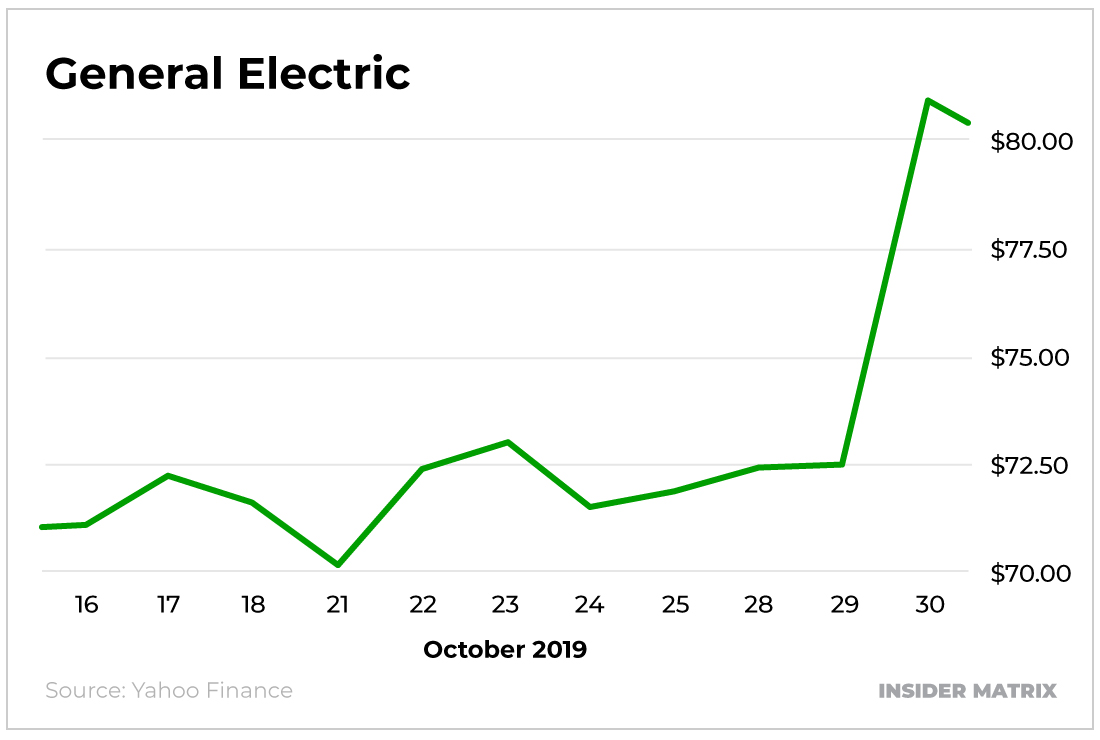

General Electric (NYSE: GE) is an American business standard. It’s been around since the 19th century and has been a giant across several industries… But its recent fortunes haven’t been as illustrious. That’s why it was odd when I saw a massive cluster of insider purchases all on one day, October 1, 2019.

Nine different directors all bought General Electric. Collectively, they picked up 53,792 shares. Now, while all of those insiders were directors, nine of them all buying in at once on a stock that had been in the doldrums caught my interest. So I did a little digging, and on October 16, 2019, I recommended General Electric options.

Then, at the end of the month, General Electric beat earnings expectations and company leadership raised the cash flow forecast. Shares jumped on the news, and on October 30, 2019, we closed out that General Electric position for 123%.

Given that the third quarter of that year had just come to an end, odds were the company had a very good quarter.

Another special case when it comes to insider buying is biotech and pharmaceutical companies. When insiders buy here, it’s usually because they have good information from clinical trials long before the Food and Drug Administration (FDA) or the public knows about the trial data.

These companies aren’t as speculative as the turnaround plays, but they do hinge on the final outcome of the trial. So they do carry a higher-than-average risk.

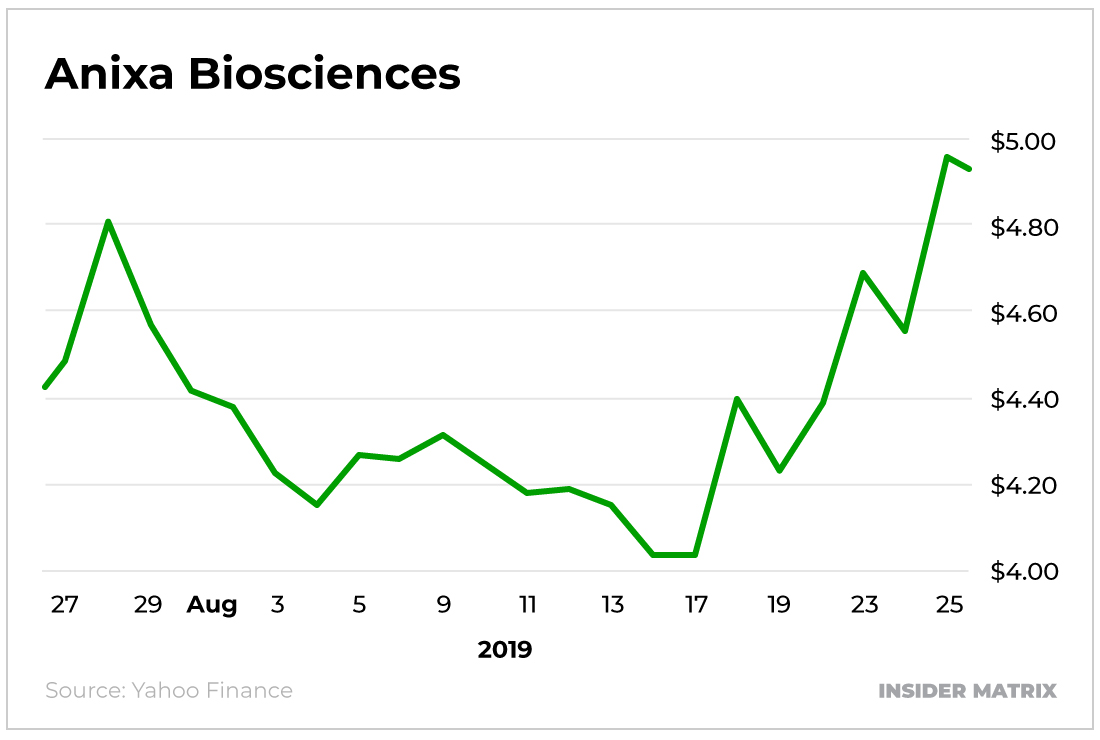

A good example here is Anixa Biosciences Inc. (Nasdaq: ANIX), a small drug company currently developing vaccines for various cancers, like breast and ovarian cancer. In July 2021, several insiders loaded up on shares in anticipation of something big on the horizon.

First were Lewis Titterton, Emily Gottschalk and Arnold Baskies, all directors who bought 54,565 shares between them for a total cost of $292,954 from July 15 and July 19. Then, Amit Kumar, the company’s CEO, bought 15,000 shares between July 20 and July 27, tipping me off to a serious opportunity.

While I would have liked to see more non-director insiders buying, I couldn’t ignore this sort of cluster and this sort of volume. On July 26, I recommended Anixa, and we were rewarded handsomely…

On August 18, 2021, the company was rewarded a patent for its ovarian cancer vaccine technology. The shares surged, and we walked away on August 25 with a 20% gain. Not bad for just under a month.

There might also be situations where insiders are making purchases far larger than the norm. I’m talking about buys in the millions of dollars. But those sorts of purchases are made by shareholders who already own a large chunk of stock. While this looks good on the surface, it makes me wary. These are long-term investors – value investors – who can wait years…

And I’m not interested in waiting years. Most of the buys I’m looking for come to fruition in a year or less.

The main variable for us here is the market itself. If it’s a 2008 type of market or even a 2020 type of market, what insiders did in 2007 or 2019 isn’t going to matter much.

But the bottom line is that by positioning your options plays based on cluster buying by company insiders, you can capitalize on knowledge you could never have. It’s the single best indicator that a company’s shares are on the way up.

Profiting From Insider Trading… Legally

There are few feelings better than knowing you have an edge in the market over your fellow investors. And insider purchases – where you follow those few traders who know what you don’t – are how you get that edge.

And the best part is that it doesn’t require any complicated technical patterns, charts or the mathematical mumbo jumbo that dominates the financial media. It doesn’t require any esoteric knowledge, just an understanding of basic psychology.

Ignore the news…

Ignore the panic-selling on Wall Street…

Simply follow the money. People are often very careless about their words, but they tend to be much more careful about what they do with their money.

Keep that in your mind and this guide and my checklist in hand, and go dominate the market with the new ace up your sleeve…

And be sure to be on the lookout for your next Insider Matrix alert.