How to Pick the Perfect Option for Your ProfitSight

First and foremost, welcome to ProfitSight

By now, you’ve seen our Quick Start Video…

You’re familiar with the tabs

You’ve chosen your symbols for your personal watchlist…

Now you’re ready to start trading!

This written guide will serve as a reference to check back on while you select your ideal option and pattern opportunity.

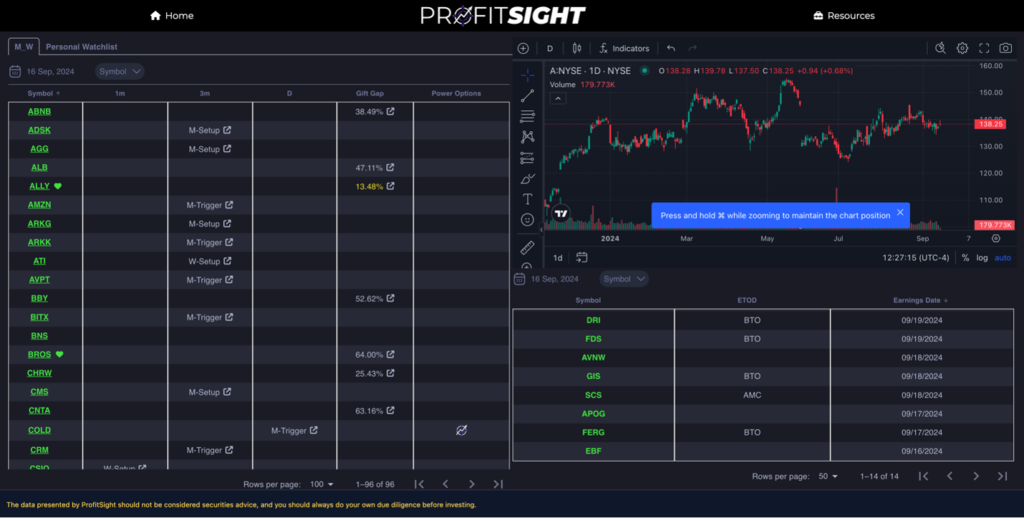

We trade two different strategies with the ProfitSight system, W+M patterns and Gift Gaps.

The process is very simple we’ll have you trading both in no time – if you follow these guidelines.

So, let’s begin!

Step #1: Identify Your Patterns

Our first 3 columns are devoted to the W+M pattern tracking.

Browsing through there you will notice the patterns setting up down the rows and then eventually some of those will trigger, you’ll see the alert convert from a W or M “Setup” to a “Trigger”.

Click on the trigger text to bring up a pattern info panel.

As you can see in the example below with an “M-Trigger” on ICE in the daily column.

After the Symbol and Date from top to bottom you’ll find some great info.

Keep in mind that the prices in this panel are all in reference to the underlying shares of the stock and are not option prices.

- MW Trade Info – What timeframe and pattern type you are working with. With M Patterns you are looking for a downward move, with W’s the opposite.

- Entry price – the price that you would ideally like to time for your entry with the corresponding option.

- Stop Price – the price that you would ideally like to plan your exit around if something were to go awry.

- Conservative Profit Target – the first target price for taking gains.

- Aggressive Profit Target – the second, riskier and more lucrative target for taking gains.

Based on this trigger pattern panel, the software was looking for a $2.69 downside move on ICE ($157.88 entry price – $155.19 conservative profit target = $2.69), with possibly even more downside from there represented by the aggressive profit target of $152.49. If you wish to aim for more profit, you can stay in the trade until the aggressive target is hit.

Step #2: Know Your Time Frame

Once you know your underlying price targets, the second step is for you to determine your time frame.

More specifically, this step requires you to determine how long you’ll be around to track and monitor the trade.

For example, do you have a lunch meeting that’ll require an hour or two of your time later this afternoon?

What timeframe is the pattern in? 3-minute? 1-minute? Daily? Expect a longer timeline for wider charts 1-minute patterns will play out in hours while daily patterns could take weeks.

Are you leaving for a vacation the next day that will keep you out of the office for the next week?

Or will you be around for the next day or two – and thus you’ll be able to track the trade?

Your own personal time frame will determine which expiration date you choose.

If you’ll be around, then choose an expiration date one week out.

If you’ll be in and out for the next few days, then choose an expiration date one to two weeks out.

If you’re going to be out of town – or unable to track your trade on a day-to-day basis – then maybe give yourself a full month of time. Or maybe skip the trade altogether and trade the next signal that comes in when you’re able to trade.

The point is, make sure that you’re trading in a way that works for your schedule. Wall Street doesn’t care if you have an afternoon tennis match or a lunch date. The markets move according to their own schedule – and thus you must trade accordingly with what fits into your own personal agenda.

As a basic guideline, always give yourself at least one week of expiration time.

That way, you can account for any “land mines,” as we call them, which are unforeseen news events that could temporarily impact your trade. If you give yourself an extra day or two, you can withstand any unpredictable news events and still be able to come out on the winning side of your trade.

Now that you have your share price targets for entry and exit, you can pick your option for the pattern.

We recommend choosing an option that’s as close to “in the money” as possible.

Step #3: Know Your Strike Price

Once you know your price target…

And once you know your time frame…

Step #3 is easy.

We recommend choosing an option that’s as close to “in the money” as possible for your conservative price target, then work $5 out for each of the more aggressive targets.

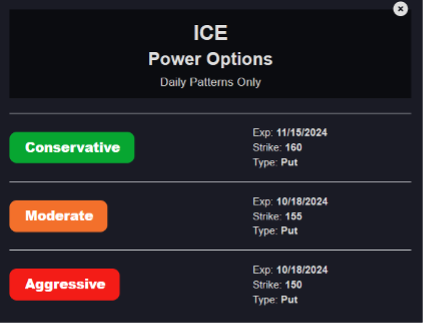

For instance, let’s take a look at that M-Pattern that formed on ICE, it’s a daily pattern so we know want a few weeks for it to play out.

The “M” formation went off with the stock trading for $157.88.

In this example, the closest “in the money” put option are the October $160 puts and then the moderate the $155’s and the aggressive $150 accordingly.

You can do this calculation for each of the timeframes you see the pattern in adjusting for the hold period.

Step #4: W+M Power Options

For our daily W+M Patterns we are happy to introduce, the Power Options column.

We do that strike price and time frame calculation behind the scenes for you and put together a card of the options plays statistically likely to capture the most movement from our daily patterns.

The Power Options are based on the daily W+M patterns, so you’ll only see them on tickers that have a daily W or M.

If you click on the Power Options logo, you will get a window like the one below for ICE that will include three potential option picks for the pattern.

Step #5: Gift Gaps

Now that you are comfortable with the power options, lets take it to the next level.

In the latest version of ProfitSight we launched one of our most powerful feature.

The Gift Gap tracker.

After the first three columns you’ll notice the Gift Gaps. The software uses our proprietary indicator for Gift Gaps that automatically scans the market for any that are happening. It only recommends a gap that’s being filled, and it tells you how much of that gap has been filled.

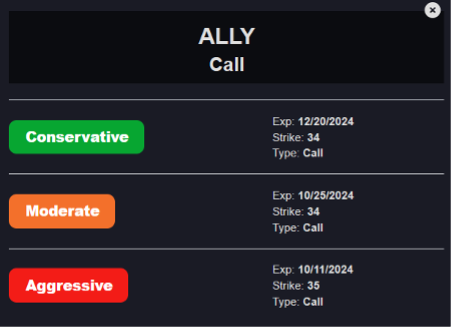

The ones in gold are in our sweet spot for maximum gains. For instance, at the time of that screenshot, ALLY was seeing a 13% backfill, meaning the timing was perfect to get in on a play.

If you click on a Gift Gap percentage in the column, you will be presented with a window that recommends three Power Options (very similar in layout to the W+M Power Options) play the Gift Gap.

You’ll see a conservative one, a moderate one, and an aggressive one. All three are valid options – choose the one that suits your needs best. Again, all our Power Options are selected by the software to offer the strongest potential to deliver you serious wins.

Summary

If you follow these 5 steps, you can best maximize the effectiveness of your ProfitSight software.

- Identify Patterns

- Zero in on a Price Target and focus your Time Frame

- Nail Your Strike Price

- Utilize Power Options

- Explore Gift Gaps

Follow these five guidelines, and you should have great success trading the triggers. Of course, as you grow comfortable with this method, you can adjust accordingly. But as a general guideline, this is a beginner’s guide to best utilize the triggers and choose which option to play.

As you know, if you have any further questions, you can feel free to message the Mod Squad – they’re always on standby to assist you LIVE anytime you need a hand. But above all, we hope this quick-start guide will get you off on the right foot.

Yours in smart speculation,

The Monument Traders Alliance Team

P.S. If you want to get more triggers, then you may consider increasing the amount of symbols that your software package scans for. To upgrade, simply call our VIP Service Squad at 888.215.5311 or 410.864.3083 and inquire about the best available upgrade offers.