The Gift Gap Trading Guide

It’s very rare that the stock market hands you a gift. For most traders, it requires a lot of skill and knowledge to trade effectively and profitably. But every once in a while, the stars align and market forces hand you a big, easy win on a silver platter.

For years, I’ve focused on trading “W” and “M” patterns. They’ve helped my subscribers make massive returns over the years, after all. But the new trading trigger I’ve found can only be described as a gift from the market gods.

I call it the “Gift Gap,” and it’s one of the best ways to target temporarily overvalued or undervalued stocks using one simple, elegant, and powerful indicator. Backtesting reveals that trading Gift Gaps has a 97% win rate. That’s as close to a sure thing as you can get in investing.

So what is a Gift Gap? What causes one to form? And how and when do we play it? Read on to find out…

Bulls, Bears, and Gains, Oh My!

Let’s start with how a Gift Gap forms.

You can look at the action in the stock market broadly or in any individual stock as a tug-of-war between bulls and bears.

The bulls are the optimists. They think the stock (or the market) is undervalued and want it to go up. They’re buying shares and call options and applying pressure to move the price up.

The bears, on the other hand, are the pessimists. They think the stock (or the market) is overvalued and want it to go down. They are selling shares, shorting shares, and buying put options, all of which apply pressure to move the price down.

Every day in the market, the bulls and the bears are in a tug-of-war over every single stock. The winner decides the direction of its price. As that tug-of-war goes on, the stock is put under a lot of pressure, both up and down. And eventually, something gives. When either the bulls or the bears lose, the stock snaps hard in one direction or the other. When that happens, it’s called a reversal. The bulls or the bears have changed the direction of the stock’s momentum.

You can see just that happen in the chart below of Insulet Corporation. The bears won the day, and shares snapped lower. That’s the gap. The gift is the big green bar you can see at the bottom of the circle…

Now, in an ordinary reversal, that green bar wouldn’t be there. The stock would continue on a downward trajectory. But in this instance, the bears won the battle but lost the war. The big green bar is a surge of buying pressure from the bulls. The stock was indeed undervalued. The bears were wrong.

After the gift filled the gap: Insulet rebounded and continued its upward momentum.

Taking advantage of a Gift Gap is like getting a flash sale on a stock. It’s suddenly undervalued and poised for a rebound. That’s why we buy right at the top of the gift, that green bar in the chart. If we do that, we can know with relative certainty that we have a Gift Gap trade and not a run-of-the-mill reversal.

See, you need to make sure the stock has enough momentum to fill a gap. The ideal time to do this is when the gap is backfilled by 10% of the move. So if the stock dropped by $1, the gap will hit our trigger when buying pressure has made the price surge back by $0.10.

Take a look at this Ecolab chart.

See the green bar? It backfilled the gap – it gave us a gift – when it hit 10% of the size of the gap.

And the result was incredible…

If you buy after the 10% backfill of the gap and hold for the first leg of the fill, the first quarter move of the gap trade, you hit our sweet spot, the 97% win rate we found in our backtesting. It’s perfect for short-term trading.

It works in reverse too. You can use the Gift Gap even when the bears win out. The bulls might drive a stock up temporarily, creating a gap. But the bears will fill that in, and if they fill it in by 10% or more, that stock will be on the way down. Just take a look at this Marathon Oil example.

And now, as a member of my ProfitSight service, you have access to a proprietary, sophisticated suite of software to capture massive profits from the Gift Gap, Perfect Timing Indicator and Power Options…

Gaining an Edge in the Market

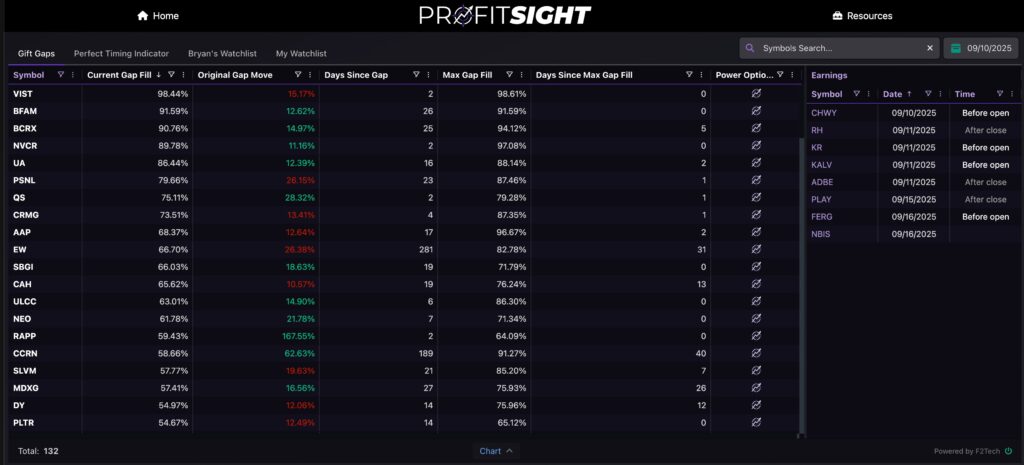

Once you’ve logged in to ProfitSight through the Monument Traders Alliance Command Center, you’ll be greeted with a page that looks something like this…

As you can see on the screenshot above, it has all of the patterns and triggers we like to trade (with the default screen being our Gift Gap tool).

Here you can see the Gift Gaps setups across for the vast majority of stocks.

For the purposes of walking through how this Gift Gap scanner works, let’s use the following example.

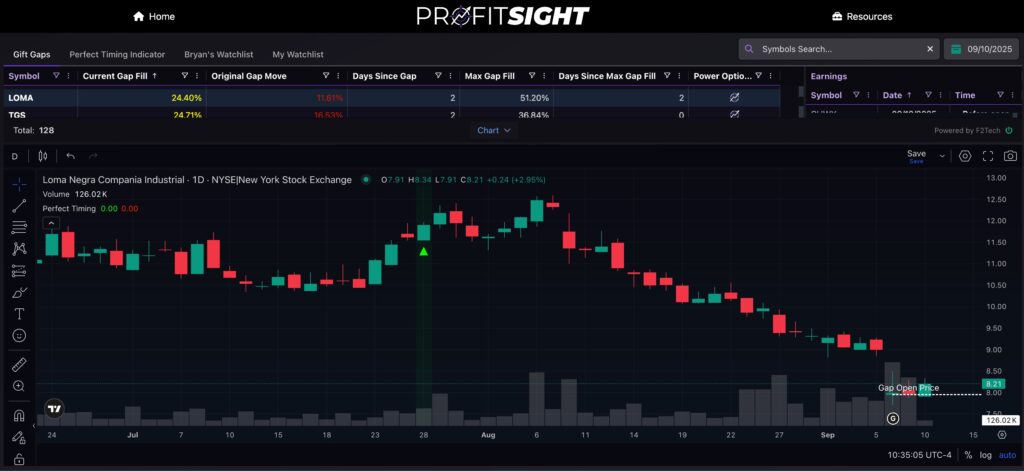

Column #1 on the left is the ticker symbol. In this case the ticker is LOMA.

If you click on the symbol, it will conveniently open up the stock’s chart where you can actually visualize the Gift Gap happening.

Column #2 next to it is the Current Gap Fill. This is the % of the gap that has been filled.

This is the most important number to watch!

The ones in yellow are in our sweet spot, between 10-25%, for maximum gains. For instance, at the time of that screenshot, LOMA was seeing a 24.40% backfill, so this number is in yellow, meaning the timing was perfect to get in on a play.

Column #3 is the original gap move. This is how much the stock moved up or down between ticks and how much will need to be filled. In the above example, LOMA originally fell 11.61%.

Column #4 is Days since gap. This is how long ago it originally gapped up or ddown. In the LOMA example above, it had gapped down within the previous 2 days.

Column #5 is the max the gap has been filled. Stock movements aren’t linear. Sometimes, a ticker will partially fill and then fall a little bit. This figure shows that at one point LOMA filled 51.2% of it’s gap.

Column #6 is how long it’s been since the max gap fill. In this example, LOMA partially filled 51.2% of it’s gap 2 days prior (the same day it gapped down)

Column #7 is how you access our Power Options feature (Note: You must have the Gold level or be a part of the Monument Traders Alliance Inner Circle. Reach out to us in ModChat to upgrade)

When you click on the white and purple symbol it will open up a popup window that recommends three Power Options to play the Gift Gap.

You’ll see a conservative one, a moderate one, and a high-risk one (sometimes there will only be conservative and high-risk options). Pick the recommendation that best suits your risk tolerance.

The software uses our proprietary indicator for Gift Gaps that automatically scans the market for any that are happening. It only recommends a gap that’s being filled, and it tells you how much of that gap has been filled.

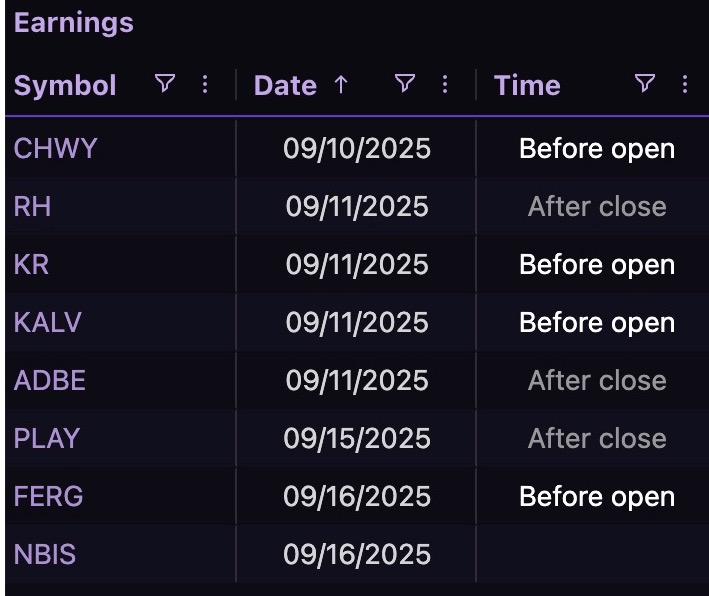

To the right of these 7 columns, we also added a bonus feature that displays all the scanned tickers that have upcoming earnings announcements (which could fuel the fill of these gift gaps).

Altogether, ProfitSight is a trader’s best friend.

If you have any questions about using our Gift Gap feature…

Reach out to us anytime inside our Mod Chat inside the Command Center.

To see this feature (and our other features) in action, make sure to watch our getting started video here.

Happy Trading!