The Insider Matrix Guide To Paper Trading

First and foremost, welcome to The Insider Matrix!

What we’ve created here… and what you’re now part of… is the most powerful – and revolutionary – trading product on the market.

I hope you’re excited – because the way you create daily wealth could change forever – and it all starts now.

But before you start trading your real money – it’s critically important that you get familiar with trading.

That’s why we recommend that you set up a paper trading account.

This offers you a number of advantages…

First, you’ll get familiar with how to enter and exit trades.

Second, you’ll get comfortable with how to place your orders – and what the option recommendation language looks like.

And third, you’ll get all of your mistakes out of the way NOW – before you’re using real money.

For instance…

Did you buy a put – instead of a call? Oops.

Did you sell – instead of buy? Oops.

Did you trade the March 1 expiration – instead of April 1 expiration? Oops.

These are all rookie mistakes that we’d rather you make now – in the preparation stage – that costs you none of your own money.

Taking the time to do this exercise right now – at the start of your trading journey – will eliminate more mistakes – and make you more money – than anything else you can possibly do.

So, let’s get started…

This guide will walk you through the entire process – step by step.

Step #1

What’s the best way to create a paper trading account?

We recommend creating a paper-trading account using TD Ameritrade’s paperMoney® – which uses the ThinkorSwim platform.

We like this platform the most because it best resembles a real-life options trading account.

In order to create a paper-trading account with TD you’ll need to have an existing account with them. Getting one is simple.

You’ll be asked to fill out some information, i.e. your name, address, number, etc.

After filling out that information, you’ll need to follow the steps below…

Create an ID and password.

Once you’ve registered for your paper trading account you can download the ThinkorSwim platform to your desktop so you can begin your trading journey.

Click this link to start the download process.

You’ll then be asked to complete the installation, there will be three separate instructions listed, one for Mac users, one for Windows users and one for Linux users.

Once you have completed your ThinkorSwim application you can log in and get started!

*IMPORTANT: Please note that you will need to select “Paper Money” NOT “Live Trading” before logging into your account.

Step #2

Once you’ve done that – it’s time to have some fun!

You’ll be happy to know that ThinkorSwim awards you $200,000 of “play money” to get you started.

Please keep in mind that even though you have a large account, you’ll want to pretend that it’s actually real money so you’re confident in yourself when you decide you’re ready to open up your own personal account with actual money.

To begin – allocate anywhere between 3-7% of your total account value for entering a new trade. If an option price is listed as $1.50, you need to multiply that by 100 to get the true dollar cost (which would be $150 in this case).

After all, every call and put option gives you the right (but not the obligation) to buy or sell 100 shares of stock at a certain time – for a certain price.

So, whenever you see options listed- please realize that the true dollar cost of that option is found by multiplying that price by 100.

To place a trade, you’ll want to click on the trade tab located at the top of your screen.

Two things to note…

The options chains are listed at the bottom of the screen.

The call options are listed to the left – and the put options are listed to the right of your screen.

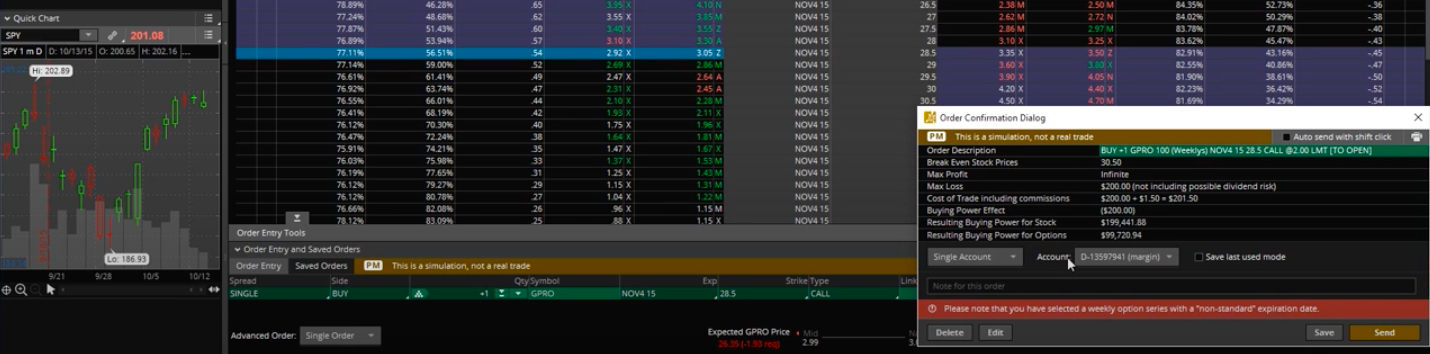

See below…

The drop-down arrows located next to the options chains show the expiration dates associated with them.

If you know what expiration date you’re looking for, click on the drop-down arrow next to the date, and you’ll see all the contracts associated with that date.

The strike prices are listed directly in the middle of your screen along with the expiration date.

For the number of contracts purchased option, you’ll want to click on the arrows located to the right of the number of contracts and select one (As a general rule, you should only be purchasing one to three contracts to start).

Click on the option you’d like to purchase and select “Buy” then click “Single”.

The option you selected will appear at the bottom of your screen where you can then right click on the order and select “Confirm and send” and then click “Send.”

See below for details…

And with that… Congratulations! You made your first options trade!

NOTE: In some platforms, to enter a new options order, you’ll “buy to open.” And then, when exiting an options order, you’ll “sell to close.”

Step #3

Now, this is important…

Once you’ve set up your paper trade account, and you’ve gotten comfortable entering and exiting trades.

Sure, you might feel like you’re missing out on some big winners.

But – paper trading is critically important for your long-term trading success.

You see, trading is a marathon – not a sprint.

Don’t be that member who joins The Insider Matrix – goes ALL IN on the first trade presented – and wonders why they’re not successful.

Please – do this right.

You’re already well on your way to generating life-changing wealth – but you have to set the proper groundwork.

Your profits depend on it.

So, paper trade for awhile, give yourself the time to learn.

Then, you’ll be ready to unleash yourself for real!

And that concludes our paper trade set-up manual.

Thank you for taking the proper sets to become a true pro trader.